$10B Social E-commerce Platform from China 🇨🇳- Xiao Hong Shu/ RED (小红书)📕

E-commerce sales in China in 2020 were $2.3T & Social Commerce accounted for ~$240B of that. Xiao Hong Shu is one of the front runners in the space, helping brands build proximity with potential users

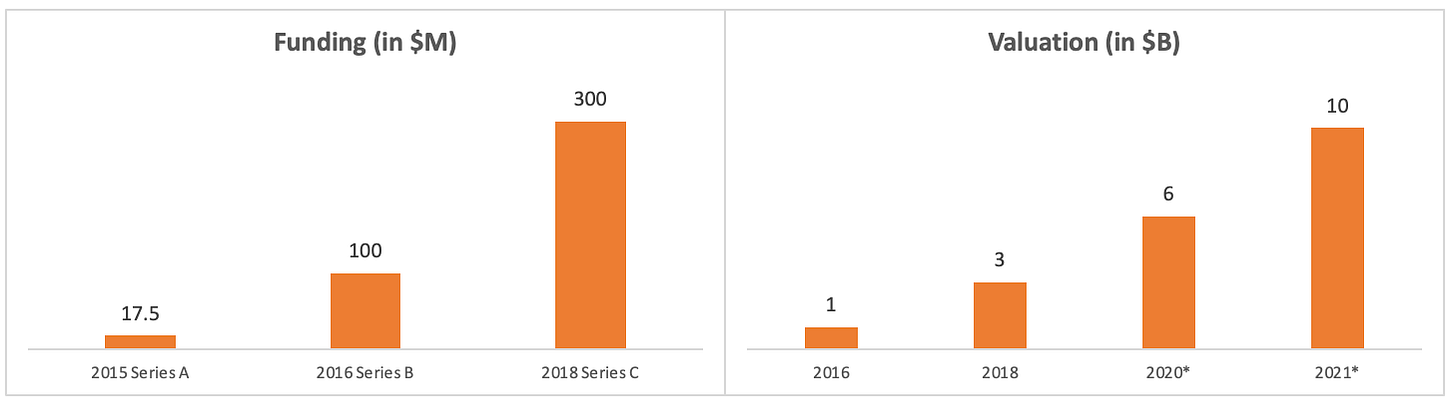

Xiao Hong Shu (小红书) or Little Red Book (RED) is one of the largest social commerce platforms in China. Founded in 2013, RED has raised over $400M+ and is expected to file for its public offering for $10B+. It boasts of over 450M+ users, of which over 70% are born in the 90s. Its success makes one wonder if information-first platforms can build a successful commerce platform. Let’s do a deep dive on RED to find out.

What is RED? 📕

RED is a platform for users to post and discover content on beauty, fashion, travel, food, etc,. and also shop from brands of their choice.

E-commerce in China 🛒

China is the most evolved e-commerce market with $2.78 Trillion with over 45% of total retail sales being ‘E-commerce sales’ and 780M+ online shoppers in 2020.

What is Social Commerce? 📱

Think of social commerce as interaction of Social Media and E-commerce, where commerce is influenced by online communities and social interaction. It also allows brands to communicate better with their potential customers.

Social Commerce is a fast-growing market in China!

RED’s evolution ⏱️

RED started as a shopping-related info. platform for mainland Chinese users to learn more about shopping/ traveling in Hong Kong. Within a few months of launch, content about shopping experiences overseas was being generated and shared.

Since the users also had intent to make purchase, in late 2014, RED also enabled commerce, letting brands to sell to its users.

Value Prop for Users 👥

Authentic information

Users are looking for information regarding subjects like- beauty, fashion, food, restaurants, vaccination, etc. RED is able to provide content across several subjects, which is user generated (UGC).

Content Recommendation

RED learns about the interests of a user and recommends relevant content which enables high stickiness, and users spend their idle time scrolling and window shopping.

Follow influencers

Based on individual interests, one can follow influencers (or KOLs). These influencers subsequently also promote brands which also synergize with them and allowing users to access these brands as well.

Shopping

The KOLs (influencers) can also sell branded products to their fans, conducting live sessions. Brands can also directly sell in RED’s mall by creating their brand page.

Value prop for brands 💄

They get access to a highly engaged community and influencers to drive conversion and sales!

Business Model 💼

RED makes money from advertising, e-commerce commission, and virtual gifting.

RED’s Creator Center 🎯

Launched in Jan’ 2020- users with more than 5K followers, who have posted 10+ notes with more than 2K+ organic views in past 6 months, without violating any rules, can apply for RED’s Creator Center.

Creators get access to insights about the followers and analytical feedback.

Creators can also initiate their live streams, which is not open to all.

Active creators can connect with 20K+ brands directly through platform, without being signed up with an MCN.

RED’s user base has scaled up very fast to 450M+ users, with strong network effects📈

Alibaba invested $300M in RED 💰

Alibaba’s investment in RED just reinforced the rising importance of social e-commerce and why it’s also important for traditional e-commerce platforms like Taobao (owned by Alibaba) to build close relationships with social e-commerce platforms.

Taobao integrated with RED, allowing users to like, comment and bookmark RED’s content directly from the Taobao app.

Moderation ♻️

RED, being a UGC focused platform, needs to have strong control over the content being pushed out.

RED was banned in 2019 for 3 months due to ‘harmful online content’.

At one point, the platform was blamed for having fake posts by influencers promoting brands. By December 2019, it had deleted over 4.4M fake posts.

Market seems exciting with large content platforms like Douyin focusing on commerce aggressively 🚀

In Indian context, e-commerce is expected to grow to a $200B Market (sales) by 2026 🚀

If social commerce represents a ~6-7% market opportunity, it could mean a ~$2B GMV market today. Given the advent of new age consumer brands, it could increase up to ~10% within next 5-6 years and be a ~$20B GMV market.

Some leading players in India: Meesho, Glowroad, Trell, Bulbul, Simsim, etc.

To conclude, I think the following are the key learnings for new direct to customer social commerce platforms:

Pick your niche

Being horizontal might seem to expand the TAM, but it is important to pick the categories where one’s expertise lie, keeping in mind there is a demand pull.

Eventually, platform can naturally expand into other categories. It’s important to enable relevant category where purchasing is the next step after awareness.

Know your TG

It’s not relevant to all kinds of smart phone users. Appropriate positioning and targeting is essential to build a sticky platform and enable strong network effects.Incentivising Creators

Incentivising creators with long term economics in mind is the key for influencer led UGC platform. Creator Program (like RED’s) provides exclusivity to creators and motivates them to create engaging content and monetise it.

Content first or commerce first?

Building a commerce first platform is equivalent of competing with likes of Amazon, Alibaba, Flipkart, etc., hence going content first could enable differentiation. Building content first platform might seem expensive but the network effects compound over time. PS: Content should be relevant to shopping (commerce).

Don’t forget Ads!

Although social commerce might sound like building e-commerce layer on top of community, but there are several times when the purchase might happen outside the platform’s ecosystem. Hence, it’s important to also build relationships with other commerce platforms; and monetise by letting brands advertise (not just sell).

If you have thoughts on social commerce, feel free to reach out on rahul@beenext.com. Let’s exchange notes?