Physics Wallah is the new BYJUs? 📖🇮🇳🚀

What started as a YouTube channel for Physics, is taking a shot at the entire EdTech segment in India! Can PW become the largest EdTech company in India? Let’s find out.

Welcome to Old Rope. I write on emerging trends from the East! 🌏 Subscribe to stay updated.

Until 2021, Physics Wallah [PW] was not so popular in the EdTech ecosystem even though it was a rage amongst the NEET and JEE aspirants in India. NEET and JEE are the largest entrance exams in India for medical and non-medical streams for UG admissions. Fast forward 2022, PW is gearing up to become the largest EdTech company in India.

Earlier this year, I had written about PW.

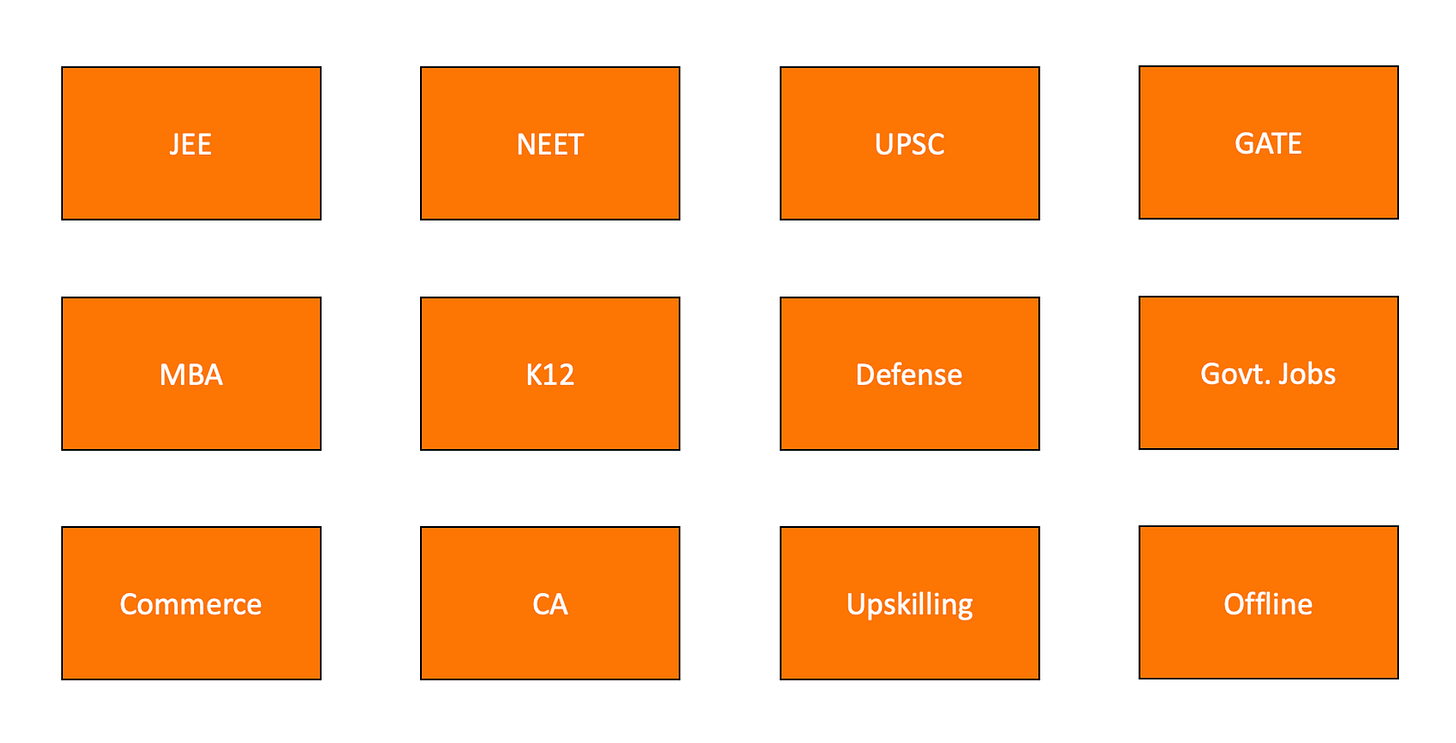

It seems that PW has evolved quite a bit. As per status quo, PW is a hybrid platform across K12, test prep and higher education (skills)- providing affordable education, catering to masses.

YouTube leadership has converted into sales and low CAC! 💰

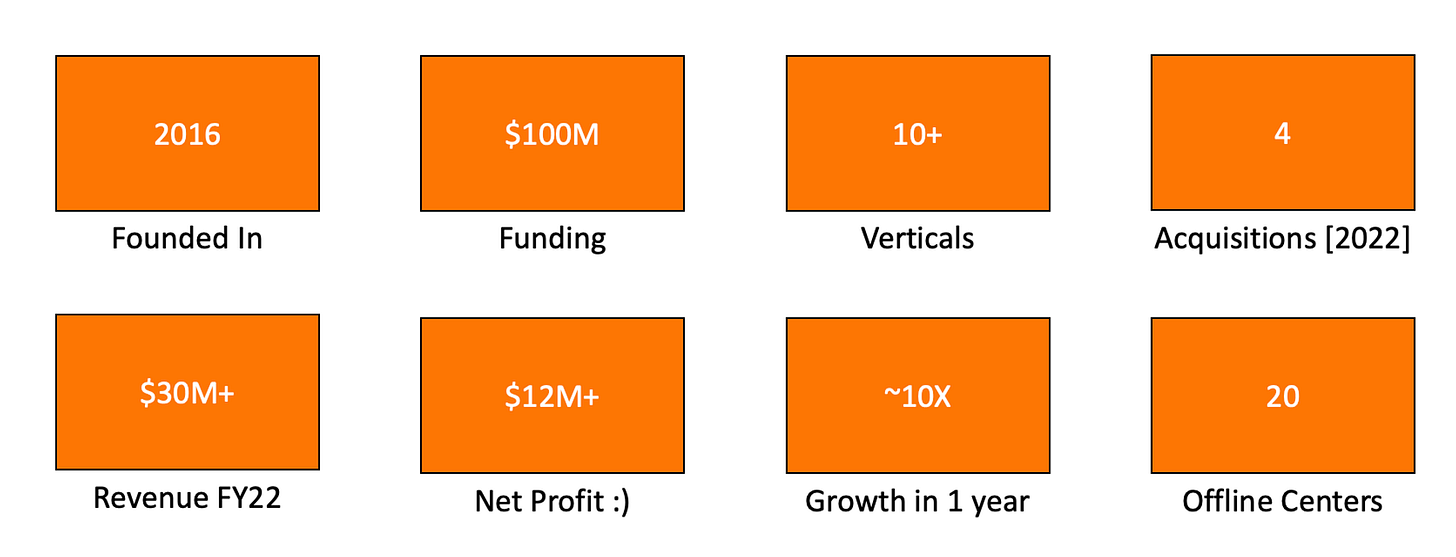

Both PW and Unacademy started as YouTube channels, gained initial traction in similar ways! Physics Wallah has been able to grow really fast with sustainable economics [~30% net margin], where as Unacademy’s growth is highly unsustainable.

Alakh Pandey, the man behind PW has been able to ensure sustainable growth with low price and mass distribution aided by YouTube. Being the face of the company has been one of the key enablers as well- proof is in the pudding.

By first quarter of 2023, PW has crossed $43M in revenue, and is expecting to close FY23 at $150M, while maintaining steady economics.

Path to becoming largest EdTech player in India! 🚵

With the current scale and economics, PW is poised to becoming one of the largest player in test prep [JEE and NEET].

For reference, around ~2.5M students appear for JEE and NEET combined. Lets say ~5M students in 11th and 12th grade combined are preparing for the JEE and NEET entrance exam; with $50 ARPU, TAM for PW is ~$250M!

But…having raised first round of funding at $1B+ valuation, there has to be a lot more in store!

With the current offerings, PW is targeting students from 10 years of age (Grade 6) to ~30 years, expanding the TAM with an aim to become a multi billion dollar enterprise.

But the new streams have competition from existing players and Alakh Pandey is not an influencer in other verticals, leaving PW with low defensibility. How are they planning to grow like JEE and NEET in other domains? Let’s deep dive!

PW resonates with the masses across! 🙌

Alakh Pandey started as a YouTube teacher for Physics, under the name ‘Physics Wallah’. In order to increase its success in other categories, the brand name was changed to ‘PW’. PW resonates with the students looking to access quality education at affordable prices across test prep. In fact, students going for upstream coaching centers like Aakash, FIITJEE, etc. are also buying PW’s subscription for supplementary aid.

PW’s ability to replicate YouTube success with Alakh Pandey at center! 📹

Alakh Pandey got popular for his unique way of teaching physics on his YouTube channel. No one could foresee that PW’s team would be able to replicate this success across other categories!

PW has launched over 35 YouTube channels, with most of the new channels being started since end of 2020. So far, the channels put together have more than 20M subscribers and growing rapidly!

If you observe closely, PW has been able to figure out a playbook for growing a YouTube channel to 1.5M+ subscribers under 12 months.

PW has successfully gamed YouTube, which acts as the top of the funnel for all the new categories. For example, PW launched a YouTube channel for MBA test prep, then posted a video from PW’s main channel to amplify the channel and plans to sustain it with star teachers as seen here.

Even though Alakh Pandey is not the subject matter expert for courses beyond Physics, but he has been able to carve out a brand for himself resonating with affordable education across.

Offline and Online strategy! 🏫

Even though online education can be accessed by masses across at lower prices, there are enough number of students who want to study offline. PW has been doubling down on its offline strategy in innovative ways- Vidyapeeth and Pathshala

Vidyapeeth: It offers offline coaching, just like any other institute at affordable rates: ~$700 per year. FIITJEE charges ~$2200 for the same offering.

W Pathshala: It offers blended offline and online learning, where lectures are streamed in the class room and doubts are cleared by subject matter associates present in the center. These centers act like satellite learning hubs for students.

PW has also been relying on acquisitions for inorganic growth! 🔏

Given the market conditions, a strong balance sheet and sustainable economics have allowed PW to focus on acquisitions as one of its growth levers. In just 2022, the company announced 4 acquisitions to strengthen its existing business as well as launch new verticals.

PrepOnline

Founded in 2019, PrepOnline focusses on preparation for NEET, Board Exams, and state-level government exams, with around 42K paid users. With the acquisition, PW forayed into online competitive exam preparation segment, while deepening NEET and Board Exams prep.Altis Vortex

Founded in 2015, Altis Vortex is a publisher of NCERT-based books for class 11, 12, NEET and CUET-UG Exam preparations and has published over 150 books. With this acquisition, Altis Vortex team will merge with PW’s editorial team to create relevant study materials.Freeco

Founded in 2020, FreeCo is a doubt-solving and resource management company providing text solutions, video solutions, and textbook solutions using automation to help students and enhance their learning experience. This acquisition has strengthened PW’s content and editorial team.iNeuron

Founded in 2020, iNeuron is a tech upskilling startup, running cohort based courses with star teachers driving demand from YouTube, with ~$9M ARR. It has been catering to college students and professionals. PW has acquired the company in a cash and stock deal, valuing it around $31M. iNeuron will drive the upskilling vertical at PW- PW Skills.

PW’s strategy team is actively seeking acquisition targets to grow fast. Industry talks suggest that PW might acquire an after-school tutoring startup for coding to double down on PW Skills.

We have seen Unacademy, BYJU’s and many other EdTech startups grow inorganically through M&As- but it has come at a huge cost! For example- Unacademy had to shut down the K12 business because they couldn’t integrate it. BYJU’s had a hard time managing White Hat Jr- which became the biggest loss leader for its overall business. One of the most common problems in such acquisitions has been the early resignation of the founders of the acquired companies.

Although PW has been doing value deals and hasn’t given crazy valuations [unlike many of its peers], it will be exciting to watch how it ensures the teams of the targets stick around for long!

Challenges surrounding PW! 🏋️♂️

Will Alakh Pandey be able to sustain his brand as an educator for all kinds of affordable learning? PW got popular due to Alakh’s style of teaching Physics. He has figured out a way to scale this strategy beyond Physics and scaling up many other unrelated categories through his own brand. The early signs of this strategy are mind boggling!

We have seen BYJU’s struggling due to rapid expansion. How will PW navigate moving away from its core? With YouTube strategy, launching new categories doesn’t come with a huge cost. As the category scales up, PW can pour in more resources, which safeguards the downside already. In terms of M&A, it’s good to see that PW is not paying crazy multiples and conserving cash- taking advantage of market conditions. Integration is yet to be seen, as we will witness as PW Skills grows further.

Can PW navigate fundraising going ahead? Being a profitable company, which is growing fast, and having raised $100M- PW is not in a dire need of capital. That being said, PW has really big ambition and to achieve it in next few years- $100M might not be enough and PW might have to raise more to capture the opportunity that lies ahead of it. Given the market conditions and the ‘so-called EdTech winter’, it will be exciting to watch as PW figures out future fundraising.

PW is a very unique EdTech company- adding value to students in the affordable segment across after school tutoring, coaching, and up-skilling- an underserved market. I really hope it stays true its values and enable high quality education to reach the grassroots.

Happy Holidays to everyone! Feel free to reach out for a chat- rahul@oldrope.club :)

Excellent and very detailed article highlighting strategies for growth by PW in simple yet effective way. Thanks for posting