EdTech in Indonesia 🇮🇩- The way forward

Indonesia is home to ~50M students in K12 category, making it a large enough market for Education industry. Let's understand the unique growth drivers in Indonesia to visualise the potential of EdTech

Welcome to Old Rope. I write on emerging trends from the East! 🌏 Subscribe to stay updated.

Indonesia is the fourth most populous country with over 276M people spread across five major islands and about 17,507 archipelagos.

It is home to ~50M K12 students- making it a large market for the education sector. Having seen potential of e-commerce, ride hailing etc., it might seem Indonesia would have a huge population for K12 education, but let’s explore this further.

Outlook of Indonesian Economy 📈

Indonesia is a fast-growing economy with 5% GDP growth annually (pre-covid) and GDP per capita of $4135 and a young population with high internet penetration (73%).

Education and Government 🏫

Indonesia hosts a large population of students in K12 (50M) and university (3M) with schooling majorly dominated by the public schooling system.

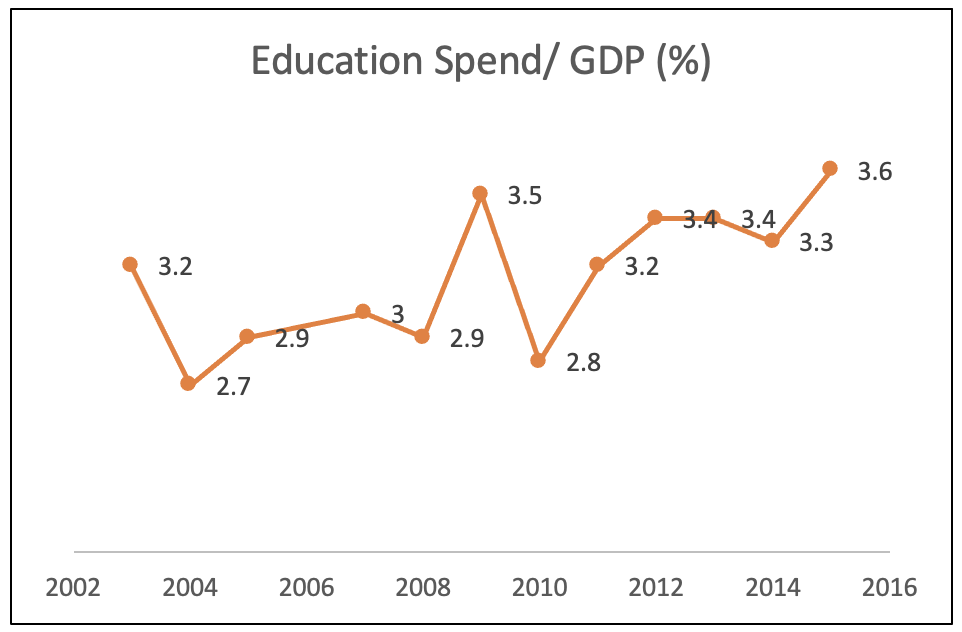

While the government’s spending on education has been increasing, but there is still room to meet other economies.

There are two kinds of schools in Indonesia differentiated on the basis of curriculum they follow- National curriculum or Religious curriculum, with the former dominating in terms of student enrolment.

It’s harder for EdTech companies to target the Islamic Curriculum schools whereas National Curriculum schools are more open for exploring partnership with EdTech companies.

Levels of Education 🎒

Following the standard format, school education is divided as follows:

The Enrolment rate drops significantly towards senior secondary school with increase in private education, though public schools dominate the system.

Vocational Education 🧑🔬

After grade 9, students have an option to either apply for Senior High (SMA) or Vocational High (SMK).

Vocational high schools offer over 140+ specialisations- agri-business tech, business and management, etc.

Graduates from vocational high schools are ready to join the workforce or they can pursue higher studies

Examination System 💯

The Indonesian Education Ministry has recently introduced a new system for national assessment- AKM, focusing on all-round development. This has been done post the discontinuation of the Ujian Nasional National Exam (Grade 9 and Grade 12) in 2020. The key driver has been a need to reduce emphasis on academic learning and shift towards overall student development.

Students need to appear for a national level University Entrance Exam which is called UTBK, similar to GaoKao (高考) in China, or JEE in India. Private universities might have their own entrance exam.

Students may change schools with AKM from junior secondary to senior secondary

There is no equivalent of Zhong Kao (中考), reducing the pressure on students

As mentioned above, the enrolment ratio reduces significantly at secondary education level. It reduces further as students go to university.

It is important to note that the minimum wage guaranteed to workers in Indonesia with minimum qualification is $310 per month.

EdTech Market in Indonesia 🧑🏫

Given its large population, the Indonesian EdTech market seems very large at first sight, but it seems to be growing at a slower pace compared to China, India, etc.

Assuming $100-$200 annual expenditure, it seems the K12 market for EdTech in the long term can be $5B- $10B.

However, it is important to note that unlike India or China, there is less peer pressure and competition for parents and children.

After-school tutoring: Hottest sub-sector so far 🔥

Just like other EdTech markets, after-school tutoring has been popular in Indonesia, and local players lead the bandwagon. However, the average revenue per paying user is relatively low and monetization has been a key challenge, unlike in India and China.

Language Learning: International competition 🌐

English/ Mandarin as a second language is an exciting opportunity as Bahasa is the dominant mother tongue in Indonesia. Even then, no company has broken out locally, given the competition from international players. For example: Lingoace mentioned below is a Singapore-based company.

LMS Platforms: Competitive Space with Limited TAM 💻

Several LMS Platforms operating with SAAS business model have gained early traction and have been distributing with government relationships across many public schools. Usually schools pay $5/- per student per year, which imputes a market size of $250M (50M students). Additional content led upsells can be built in but that competes with the after school players and it is unclear whether the distribution advantage really helps or not.

Extra curricular education: Blank Canvas 🎨

There are not many players focusing on extracurricular education locally. Given the policy push and less peer pressure, extra curricular could be a thriving sub-sector in Indonesian EdTech landscape.

Some international companies like Brightchamps, etc. have been offering coding classes to children in Indonesia.

By the way Brightchamps is hiring across roles, in case you are interested reach out to: recruitment@brightchamps.com

Conclusion 🖊️

EdTech in Indonesia will evolve in the coming years. In the meantime, it will be crucial to closely watch the trends and behavior of students and parents. Listed below are the key takeaways:

Important to evaluate the depth of sub-sector(s) and future potential with policy alignment

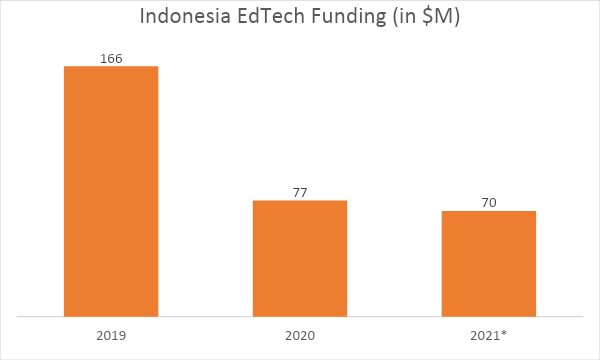

Upstream capital has been relatively limited so far, but the larger funds have been getting active since 2020 <Sequoia, GGV, GSV, Shunwei, Northstar, etc.>

Monetization is still a challenge and business models in B2C business are driven by large top of the funnel systems; for B2B/ B2B2C models, the government plays an important role

Parents and students in Indonesia are not under deep pressure as seen in India and China, with minimum wage guarantee from the government resulting in less competition for opportunities

Extra-curricular education seems to be under-penetrated with lots of potential!

If you are a founder building an exciting EdTech company, please feel free to reach out- rahul@beenext.com

Appeal: Indonesia is currently going through a tough time due to the Covid-19 pandemic, you can show support here (or any charity of your choice)

I get a lot from the blog, thk you!