The billion dollar Google Classroom of China- 17 Zuo Ye (一起作业)

A collaboration tool for teachers, students and parents - 17 Zuo Ye is the biggest company in its segment in China. Let's deep-dive into the company that has captured over 60% schools nationally!

Online education platforms have witnessed expedited growth on account of the Covid-19 pandemic. As an example, Google Classroom doubled its userbase to over 100M active users (with free access) across the world. 17 Zuo Ye, with over 54M registered students, has also been positively impacted by the pandemic, with higher adoption of the after-school classes that have been offered in addition to its homework/ assignment platform. While I have come across different avatars of 17 Zuo Ye in various markets including India, the growth drivers of each these markets are not equally synonymous. Today’s blog is an exploration of 17 Zuo Ye and the landscape along with brief implications for India.

17 Zuo Ye or Yi Qi Zuo Ye (YQ) is one of the biggest K12 platforms in China (and the world), connecting teachers, students and parents. In Mandarin (Chinese), 17 sounds like the word together (一起) and Zuo Ye (作业) means homework, hence the name 17ZuoYe- meaning Homework together.

→ Teachers use YQ to create assignments, send it to the students and also correct them with the platform’s aid to save their time.

→ Students use the platform to complete the assignments and practice/ revise concepts. They can also book live classes for after-school tutoring.

→ Parents use the platform to track their child’s performance and communicate with the teachers. Additionally, they can book the live classes provided for their children.

After-school Online K12 Market in China is expected to reach $57B by 2024

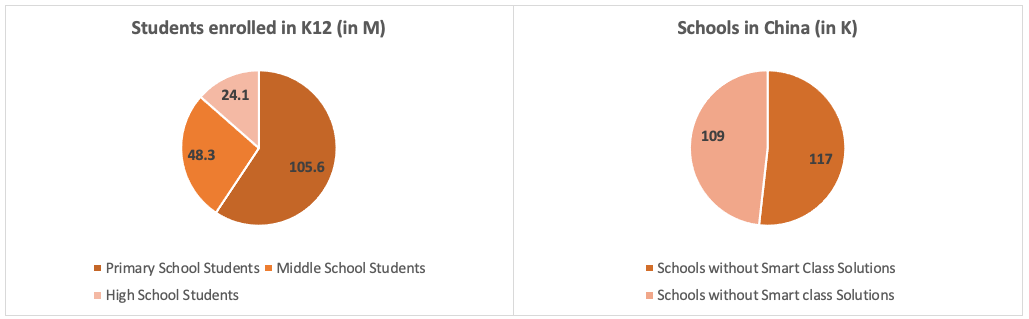

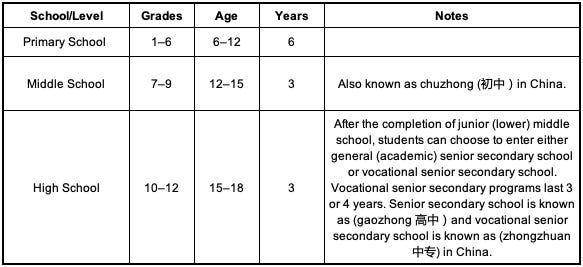

As of 2019, China is home to 178M students enrolled in K12 education across 226K schools, out of which over 52% use smart class solutions, i.e. use of some form of technology to improve the impact of education. By law, each child must complete 9 years of compulsory education from primary school (6 years) to junior secondary education (3 years). It’s important to note that the country has schools under the state government, and public education is the norm in China, with only a small number of wealthy kids attending private schools.

Due to intense pressure to perform well in the exams and get admission in the top high school/ university, students in China spend extra hours preparing for entrance exams. This has led to a deep after-school K12 education market in the country.

Most of the offerings in the after-school K12 Market are either in large format classes with one teacher and several hundred students, small format classes with one teacher and upto 5-7 students or 1:1 live classes. The K12 online after school market accounts for 88% of total enrolments across large format live tutoring which culminates to 55% of the total market in year 2019

YQ dominates the distribution in schools with over 60% of penetration amongst digitised schools in China

The company has been successful in reaching schools across the country in less than a decade, with the help of its free product to aid teachers in optimising their time while communicating with students/ parents, and managing assignments.

YQ Product Portfolio covers the 3 stakeholders: Teacher, Student and Parent

Teacher App:

→ Allows teachers to access content for creating and sending assignments

→ AI corrects the homework and assignments done by the students

→ Teachers can share notifications with parents and students through the app

Student App

→ Students can do the assignments and homework assigned by the teachers

→ Analytics are offered based on the performance in assignments and exams

→ Access to more exercises, which helps strengthen the concepts

→ Students can access after-school live classes

→ The app also keeps a track of the screen-time and issues notification to students as well as parents

Parent App:

→ Parents can access their child’s academic performance

→ They can also control the usage of phone by their child by through the parental control settings

→ They can access the additional content offered by the platform along with analytics-based live classes

Live Class App:

The success of YQ’s live class offering (monetisation!) to its students in the school ecosystem led the company to extend the s offering to students outside the school ecosystem as well. These are large format classes across all the subjects, competing with the likes of GSX and Yuanfudao.

Business Model evolved from selling digital self led courses to large format live classes in 2017

YQ’s core thesis was to gain access to widespread school networks across the country by offering the platform for free, and then monetising a proportion of it by upselling courses. It was quite successful in satisfying the digital mandate with over 60% digitised schools using YQ’s platform in the teacher-student-parent ecosystem and a MAU of ~20M.

While the company initially upsold self-led digital exercises for practice, it eventually moved to offering large format after-school live classes with batches of 200-300 students, as this format became the norm in China, with courses varying from upto $350.

Assuming a paid user pays upto $150 on average per month, it leads to a paying userbase of 86K students, which is equivalent to 0.43% conversion. (Monthly revenue is ~$13M)

YQ is at an annualised run rate of $156M but with losses amounting to $190M

After introducing online large format classes, YQ has been able to grow its revenue rapidly, with the following share of paid users: Primary School Students → 67%, Secondary School Students → 30% and High School Students → 3%

YQ’s revenue has increased 2.6 times in a year, and it appears that the company has done a great job of capturing the pandemic-induced momentum. Simultaneously, YQ’s losses have been increasing! Let’s find the drivers behind these losses.

Looking at the cost trend, it appears that the cost of revenue (payout to teachers) is in the range of ~40% and has not changed much in 3 years. As the platform has scaled, its cost of admin and R&D (technology) has naturally come down.

To my surprise, YQ is spending a significant amount of money (more than 100% of revenue) in user acquisition for its paid platform even after building a sticky platform for student--teacher communication.

Most of the marketing dollars are spent in sales personnel cost and the free classes offered for promotions and trials.

Why does YQ need to invest so much in sales and marketing?

At the first look, YQ is the #1 player with the widest distribution in the K12 space connecting teachers, students and parents. The #2 player is Knowbox ((小盒科技) which has raised over $300M and is valued at more than $1B with 40M+ registered students.

However, YQ actually operates in a red ocean, competing with well-funded and publicly listed after-school tutoring platforms.

The market for K12 after-school live classes is extremely competitive, with several giant companies (as evidenced above). To monetise effectively, YQ needs to spend significantly on sales and marketing. This makes it hard to state when it can bring such cost down as there is more consolidation expected in the space.

Like several other Chinese education companies, YQ has filed for an IPO in the US for raising $100M

Looking at the P/S ratio for publicly listed Chinese companies in the USA, I think the market might price YQ in the 10-15X revenue range, which could lead to $1.5B-$2.3B in market capitalisation; here’s the prospectus.

India has over 260M students with over 1.5M schools!

Over half of India’s ginormous student population is enrolled in private schools, even though less than 30% schools are private. Whereas in China, a majority of the schools are public.

This has created a highly fragmented schooling system, and is troublesome for a Learning Management System to capture high distribution (like YQ did), as there is no standard governing body across the schools.

Monetisation for these companies works similar to SAAS companies, where they charge the school per student, which cost is in turn passed on to the students by the school. The collection from schools is another challenge that adds to the operational complexity. Barriers to entry do not seem high as well since so far there are less network effects or content MOATs.

Some of these companies aspire to build upselling modules like YQ but it seems more challenging since gaining massive distribution like YQ is extremely difficult.

YQ is a reasonably successful company in a unique market (China) which can’t be copied blindly by startups in other markets!

→ Upcoming companies should focus on building value beyond SAAS, and build network effects by creating huge content repositories. The homework allocation can be done through platforms like Google Classroom for free.

→ In case of upselling after-school courses, it is important to do a cost-benefit analysis of the distribution since the same could lead to intense competition with existing after-school platforms. It’s not necessary that a high distribution will lead to a high conversion as well.

It could be interesting to explore a marketplace model/ branded partnership with existing after school services.

→ Data can be leveraged to help the students improve their weaker skills, which would be a strong value proposition for the teachers, students and parents. This can help carve out MOATs for the business in the longer term.

Sources: YQ SEC Filing, Frost & Sullivan Report and Times Of India