Zhangmen 掌门- Largest 1:1 tutoring platform from China

Zhangmen has filed for $100M IPO in the US, after raising $400M from Softbank in October, 2020. It has pioneered the 1:1 tutoring model but how successful is the model? Let's find out.

1:1 tutoring is considered to be highly effective as it allows a student to have complete personal attention of the tutor.

Zhangmen (掌门) was founded in 2010, and as on date claims to have tutored 545K students in its 1:1 format, with each student spending around ~$1000 on the platform in 2020 alone. Having so far raised ~$900M in capital from the likes of Shunwei Capital, Softbank, etc., it plans to raise $100M in IPO at NYSE. Is it really exciting? Let’s find out.

Zhangmen is the most popular destination for 1:1 class for students across K12 in China.

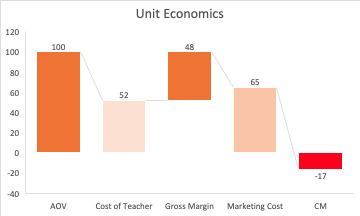

To combat the tough unit economics on account of its 1:1 format, the company launched more product offerings for its users (as seen above).

Zhangmen has not diversified from 1:1 tutoring

Although the company has been trying to diversify into other business streams, a large proportion of its revenue still comes from 1:1 classes. Since the competition in other business streams is intense along with specific platforms popular for group classes (like Yuanfudao, Zuoyebang) and kids’ classes (like Meishubao, Huohuasiwei etc.)

The revenue has been growing rapidly, with over 30% CAGR.

But how sustainable is this?

The company continues to spend $0.67 to generate $1 in sales!

Teachers are paid ~52% (+4% of server costs, etc) of revenue which has been pretty constant throughout the years. The marketing cost hasn’t seen significant improvement as it is still 67% of the revenue and the scale hasn’t helped the company overcome user acquisition. With large investments in K12 in China, CACs are not becoming any better.

Additionally, it’s interesting to see that the investment in marketing exceeds the investment in R&D by 10 times! Is it a tutoring business OR sales?!

What are the levers for Zhangmen to turn profits?

Teacher Cost

In a 1:1 model, it’s very difficult to reduce the cost of the teacher given the limited supply of high quality teachers in the market. Hence, to bring the teacher cost down- Zhangmen will have to increase efforts on small group class and AI tutoring. But, there are established brands out there which are known for those offerings, hence it would be a tough one!

Marketing

This is where I really see some hope. Given the recent regulations (will talk more later), the government might make it difficult for other players to advertise/ launch new courses. Hence, there can be organic push towards Zhangmen, given its strong brand in 1:1 tutoring. This could make unit level economics look much better!

Recent Policy Impact:

According to the reported official discussions, the government intends to regulate the management of off-campus training institutions and severely investigate and deal with institutions in matters such as unqualified faculty, and undue profiteering, including through collusion with schools. It has also proposed a slew of measures to regulate aspects like advertisement (misleading ads, content with a potential to affect mental well-being of students and parents, curbs on number of ads to reduce high marketing spends, and approval of ad content), payment schedule (collection of long-term payment to be disallowed to prevent lock-ins), licensing (of after-school centers, and approval of coursework and faculty to ensure only qualified professionals teach online), restrictions on hours of after-school training, and disallowing students under 4-5 years from signing up for after-school courses. Additionally, it might be difficult for EdTech companies to list on stock market.

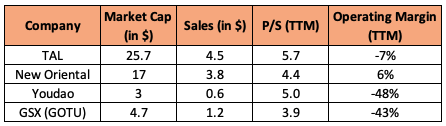

If Zhangmen goes public, how large can it be?

Looking at the current market conditions, Zhangmen could expect a 4X to 5X on it’s revenue runrate, which implies a valuation range of $3.2B- $4.1B.

PS: There is uncertainty about Zhangmen being able to successfully IPO and the macro environment is not in the best of its shape.

Recent scrutiny towards afterschool K12 market may have severe implications for Zhangmen to grow its business further or successfully IPO, but at the same time, it would reduce competition and could improve the health of economics. Jury is out!