Vietnam's EdTech moment? 🇻🇳

Vietnam is one of the fastest growing markets in SEA, gaining attention of PE-VC investments across sectors. EdTech has been a sector which hasn't seen much activity but has the time come now? 🏫 💸

Welcome to Old Rope. I write on emerging trends from the East! 🌏 Subscribe to stay updated.

Vietnam is a beautiful country in SEA sharing its borders with China, Cambodia, and Laos. Divided in 58 provinces, it is home to over 96M people.

With a population of over 16M students (K12) and education as national priority, let’s take a look at the EdTech ecosystem.

Vietnam’s Economy is growing fast!🚀

Growing at 7% (2019), Vietnam’s economy is one of the fastest growing economies in SEA; with GDP per capita being ~$2700 (2020) and internet penetration of ~70%

Like China, Vietnam is a socialist economy with a one party system led by the Communist Party of Vietnam (CPV).

Government devotes significant focus to education 📚

Vietnam has population of 16M students in K12 and 1.7M students in universities, with public education at the forefront. There is strenuous focus on education by the government (spending ~20% of its budget)- since it is considered to be one of the key strategies for economic growth. Even the society vales education deeply, as it seems to be the road to prosperity.

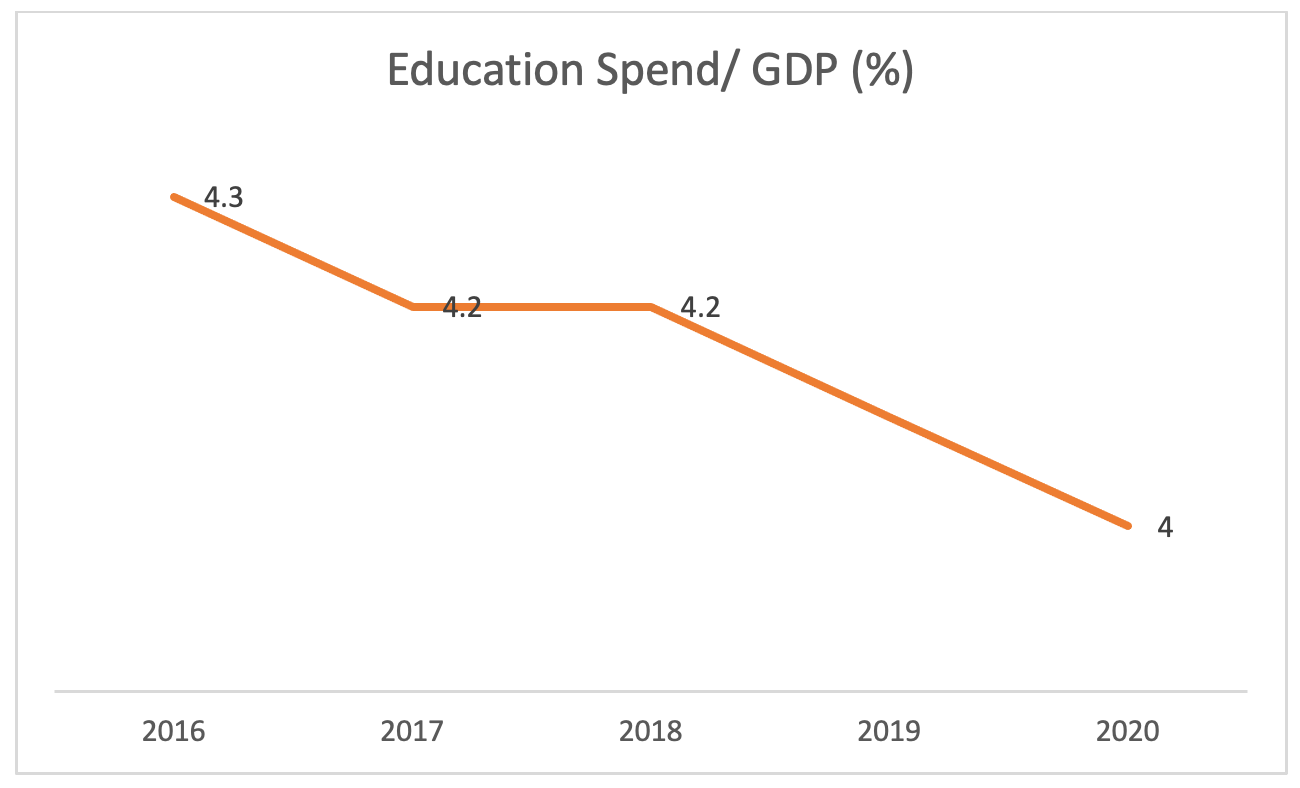

Though government’s spending on education has been decreasing, but its still on the higher side (~4%).

Number of pupils per teacher has been increasing in Vietnam, hence teacher supply might become an issue in times ahead.

Education System and Exams! 🤯

Education System in Vietnam is a state-run system of public and private education run by the Ministry of Education and Training. It is divided into five levels: preschool, primary school, secondary school, high school, and higher education.

Similar to China’s Education system, there are exams, as students graduate from one level to another which plays a key role in deciding the next school (taking location into account). Much like China (Gaokao), students in Vietnam appear for a competitive national exam (NHSGE- National High School Graduation Exam) after high school to seek admission in university. Over 993K students appeared for the NHSGE in July 2021.

Given competitive nature of examination, parents often seek after-school tutoring support for their children.

“Vietnamese parents can sacrifice everything, sell their houses and land just to give their children an education,” Vietnam’s education minister Phung Xuan Nha said at a conference in 2016.

Enrolment reduces as the levels of education increase, with some students opting to go for vocational training after secondary school, to enter the job sector sooner than later.

TVET (Technical and Vocational Education and Training) in Vietnam is a sub segment of key importance.

ADB has published a detailed report on Vietnam’s Technical and Vocational Education Training Sector in 2020.

Vietnam K12 Education Market seems to be $4.8B+ 💰

There are ~16M students in Vietnam; assuming parents are spending $300-$400 per student per year, estimated size of K12 after-school tutoring education market is $4.8B- $6.4B.

EdTech or E-learning Market will be $3B by 2023 📈

Not limited to K12, EdTech market is expected to reach $3B by end of 2023 (according to Ken Research).

It’s startling to see that the EdTech ecosystem is far from mature, compared to other emerging markets. Topica, one of the largest EdTech companies from Vietnam (platform for online educational offerings ranging from live English tutoring courses to full-on bachelor’s degree programs) has raised only $50M since its inception in 2008.

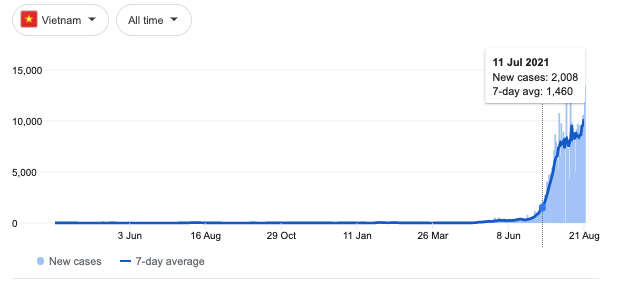

Covid in Vietnam happened in Q3 2021 😷

Across the globe, Covid has been the pivotal moment for traditional education companies to innovate and new EdTech companies to emerge; since parents and students have preferred offline education pre-covid and didn’t get a sincere chance to experience EdTech.

Vietnam govt. was very successful in keeping its citizens safe from covid until recently as Q3 2021 has been witnessing lockdowns in the major cities. So, there is window for innovation in delivery of education. It’s important to note that- being a developing nation, students in rural areas don’t have access to computers, etc. to access online education, hence accessibility will be an important problem to solve.

Parents and students prefer offline education until they witness the benefits of online education; in the long term there will be a hybrid/online merge offline (OMO) which will be sustainable. Here’s a detailed note on that:

After-school curricular tutoring, English learning and vocational learning are the most exciting sub-segments! 🤩

After-school curricular K12 tutoring is the hottest sub segment 🔥

Given the exams focused nature of education system, parents are used to accessing offline after-school tutoring for their children.

Some exciting EdTech companies like Hocmai (acquired by Galaxy Media), Clevai, Tuyensinh247 and Edmicro.

This segment is less likely to face fierce competition from international companies as the approach to learning and marketing is local. That being said, there will be fierce competition, so distribution MOATs will be important for the ‘right to win’.

Language Learning is an evergreen play field 🔡

English learning has been a phenomenon in Vietnam with offline learning centers dominating the space, for K12 and adults. Parents have been used to spending $100-$250 per month for English learning in offline centers. Industries like tourism and global manufacturing are booming, which has led to increased emphasis on ESL (English as second language).

Interesting EdTech companies in language learning in Vietnam: Elsa, Topica, and Antoree.

1:1 and small class (1:4-5) formats have proven to be successful in English learning as it provides for convenience, solves for attention and better tools. For platforms, it is also an opportunity to hire English teachers from North America, Philippines, etc.

Local players in this sector also face competition from international companies, and might see some Chinese companies focusing on Vietnam, since their domestic business has been hit.

Vocational Education will see disruption in coming years 💻

Since Vietnam’s economy is on the rise, it will create several jobs which would need semi-skilled and skilled work force. As seen above, high drop off rate from high school to university has also created need for development of talent.

Some companies to watch out for: Coderschool, Unica and Kyna.

The opportunity in this space is local in nature hence companies in this segment will not face much competition from international companies. It’s important to figure out the right business model and correlation with jobs, as that will solve for user acquisition and outcome of the platform.

Will Vietnam see an EdTech crackdown like China? Probably not! ❌

Although Vietnam and China are socialist economies with similar fundamentals, but it is unlikely that Vietnam EdTech ecosystem will face EdTech crackdown like China, anytime soon.

Given that Vietnam’s economy is still in early innings, private players need to contribute to the growth of education as a sector. Moreover, after-school tutoring has been relatively unorganised and EdTech is in infancy stage, so the sector is up for disruption for the next decade or so.

Even then, EdTech players should be watchful of regulations and the evolution of education system; and make necessary pivots, as needed.

If you are building something in EdTech and would like to chat, feel free to ping: rahul@beenext.com.

Vietnam is currently going through a covid crisis, here’s how you can help: https://give2asia.org/donate-coronavirus-fund/

Special shout out to Lien Pham and Chinh Nguyen for helping me understand the Education ecosystem in Vietnam!