Veranda Learning- India’s EdTech Thrasio for Test Prep and Upskilling! 🛒

Started in 2018, Veranda Learning is focusing on Test Prep & UpSkilling in India; actively acquiring assets across verticals & building operational leverage to build India’s largest skilling platform!

Incorporated in 2018, Veranda Learning started its operations by acquiring its first target- Race in 2020 [coaching institute for government exams]. Since then, Veranda has announced several acquisitions across test prep and tech upskilling- fuelled by debt- with online-offline delivery, riding the hybrid education wave.

Moreover, it went public in April 2022- raising ~$25M at ~$100M to continue acquiring assets using cash and debt.

Veranda- Vernacular Learning Platform for ‘Bharat’ 🇮🇳

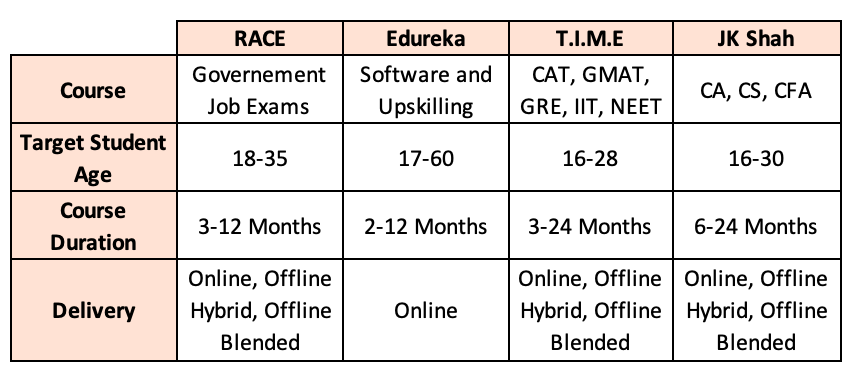

Veranda Learning offers comprehensive long term and short term preparatory courses for competitive exams, professional upskilling- through online, offline hybrid and offline blended formats; across tier 1, 2, 3 cities- with languages like English, Tamil, Telugu, Malayalam, Kannada and Hindi.

Competitive exams courses include government exams like UPSC, Banking, Insurance, etc., test-prep for JEE, NEET, CAT, etc.

Professional upskilling courses include Chartered Accountant, Company Secretary, Software training, etc.

Online learning comprises of recorded videos and online live instructor led learning model- allowing students to engage in self paced learning as well as personalised learning.

Offline Hybrid comprises of classroom teaching in centres supported with online assessments and access to self-paced learning material to enhance recall and retention.

Offline Blended comprises of twin teacher model, where a centre would deliver the course with LMS study material and a dedicated mentor in classroom for assisting students. This model helps increase access in smaller towns and cities.

The offline delivery happens with the help of franchise partners, keeping the model asset light!

India’s Education Opportunity is massive! 🦕

India’s education opportunity is massive, expected to grow to $225B by 2025!

India’s spending target has been over 6% but it has been spending only around 2.8%, though the budget estimate for FY21 pegs it at 3.5%. Hence, private intervention at various levels has been very important.

Seemingly, there is large opportunity outside K12 as well!

Veranda’s active acquisition timeline to capture skilling and test prep market! ⌛

Legacy brands in Veranda’s portfolio! ✨

RACE Chennai

Established In: 2012

Courses: Banking, SSC, TNPSC

Geographies: Tamil Nadu, Kerala, Karnataka, Punjab

Delivery: Online + Offline [25 Franchise Centers]

Languages: Tamil, Telugu, Malayalam, Kannada, English and Hindi

Revenue (FY 2020): $6M

Acquisition Valuation: ~$14M

Edureka

Established In: 2012

Courses: Software Upskilling, Data Science, etc.

Geographies: India, USA

Delivery: Online

Languages: English

Revenue (FY 2021): $10M

Acquisition Valuation: $33M

T.I.M.E.

Established In: 1992

Courses: CAT, GATE, GMAT, JEE, NEET + Pre School Chain

Geographies: PAN India

Delivery: Online + Offline [~188 Franchise Centres + ~220 Pre Schools]

Revenue (FY 2021): $15M

Acquisition Valuation: $36M

JK Shah Classes

Established. In: 2000

Courses: CA, CS, CFA

Geographies: PAN India

Delivery: Online + Offline [65 centres]

Revenue (FY 2022): $12M (EBITDA: ~$5M)

Acquisition Value: $53M [Acquired 76%]

Veranda has acquired 76% in JK Shah Classes, leaving 34% to be acquired at ~10X EBITDA multiple of FY 2025, trying to incentivise the management for future.

Potential for synergies! 👭

The companies acquired by Veranda have been slow at growing, so it will be important for Veranda [as a group] to enable the acquired companies grow further.

Centralisation of admin functions

The most basic synergy would be to centralise functions like HR and Finance which could bring in some efficiency in the cost structure.Offline-Online

Veranda has a robust LMS which can be leveraged by companies to diversify the delivery of courses in the online, offline hybrid and offline blended mode.Expansion across geographies

Given the strong regional offline presence of companies, Veranda can use the existing real estate to increase the course offerings in the same centre, there by increasing the ultilization of the centres and enabling faster geographical expansion.

Indian EdTech market has been a hotbed of M&As 🔥

Various growth stage EdTech companies have been eyeing M&As as a way to fuel growth. M&As have been able to support:

Expansion of current business offering

Vertical integration

Addition of new categories and diversification of business

It’s important to note that M&As have also caused distraction for the core businesses- as it has been seen in the case of BYJU’s and White Hat Jr, Unacademy and Swiflearn/ Mastree. Moreover, it is difficult to retain the management of the acquired companies- Unacademy is a case in point, where founders of companies like Neostencil, Wifi Study, Handa Ka Funda, etc.

Final thoughts! 🖊️

In April 2022, Veranda Learning went public- raising $25M at a valuation of $100M. The stock listed at 16% premium- with only 2 companies in its portfolio- RACE and Edureka and 6 months revenue of less than $2M.

The promoters of the company- Kalapathi Sureth, Kalapathi Aghoram and Kalapthi Ganesh have built software upskilling company- SSI in 1992, which grew to be one of the world’s largest education networks for vocational training in the private sector. SSI later acquired Aptech and grew into a global provider of education, and went on to become the first Indian IT company to be listed on the London Stock Exchange. Since then Kalapathi family has been involved in various businesses.

Unlike EdTech unicorns of India, Veranda has been buying profitable assets at EBITDA multiples of 8-12 with strong brand presence in their respective verticals. Since the acquired assets have been struggling to grow, the jury remains if Veranda can turn around their growth trajectory.

For Veranda’s growth, it is important to retain the key management of the targets. Most M&A’s fail due to integration issues, which is a critical risk here since the group company is relying majorly on inorganic growth to grow further.

Does it make sense to retain the brand of targets? The companies acquired have been building for decades and have established its name in specific categories. Re-branding exercise has to be done in a thoughtful manner- so that the group can benefit from a common brand but also leverage the existing brand presence of the companies.

Strong offline presence and a conscious hybrid learning approach can increase avenues of growth as well as reduce pressure on marketing.

Looking at Veranda’s stock- doesn’t look like EdTech winter 😃

If you are building in Education, looking to acquire/ get acquired, feel free to reach out- rahul@oldrope.club

Shout out to Yash Jain for flagging this exciting company!