Revolutionising food services: Dil Foods ❤️ 🚀

With advent of cloud kitchens, F&B industry has become exciting but competitive. Small restaurants've found it difficult to succeed on this channel. We invested in Dil Foods as they take a stab at it!

Welcome to Old Rope. I write on emerging trends from the East [sometimes West]! 🌏 Subscribe to stay updated.

The average Indian household allocates a staggering 25% of its income to food. The question that looms over us daily is: What should we indulge in for breakfast, lunch, or dinner? It’s natural for food services to be one of the largest consumer markets with several entrepreneurs innovating on business model, food technology and packaging, across the world.

Shout out to Xintong Zhang, for providing deep insights on China!

Food Services Market! 🍲

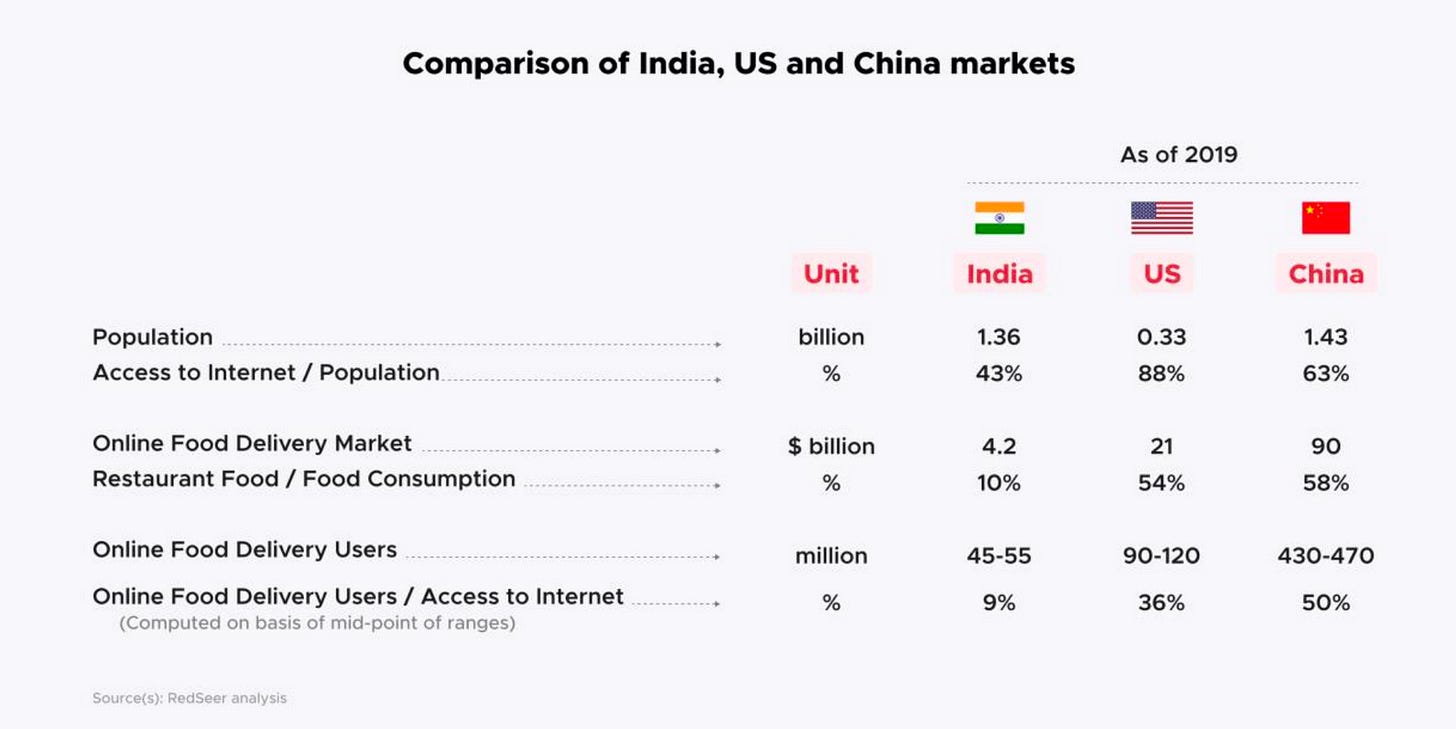

In 2019, India's food consumption reached $670 billion, approximately accounting for 24% of the country's GDP. However, what's striking is that only 10% of this enormous sum is attributed to the food services sector, encompassing restaurant dining and non-home cooked food.

In contrast, both the United States and China boast significantly higher figures, with food services accounting for a substantial 54% and 58% of their respective food consumption markets, making India's potential for growth in this sector all the more evident.

As per RedSeer, India’s Food Services market is ~$65B (2019) and expected to reach $100B by 2025. As the income levels in India are going up, food services market is expected to mature!

Cloud Kitchen Industry 🍽️☁️

In the past, dine-in restaurants began offering food delivery within their local areas as a means to optimise kitchen utilisation and cater to loyal customers seeking convenience. However, restaurants often faced challenges when it came to efficient delivery and effective marketing to expand their customer base. This is where food aggregator platforms stepped in, revolutionising the dining industry by providing a comprehensive solution that combined both discovery and delivery services for these dine-in establishments.

By partnering with food aggregator platforms, restaurants could refocus their efforts on their core competency: crafting delicious meals. These platforms, in turn, facilitated not only serving their existing loyal customers but also acted as a gateway to attracting new patrons. In exchange for their services, these platforms typically charged a commission fee, creating a win-win scenario where restaurants could concentrate on their culinary expertise while reaching a broader audience through the digital marketplace.

This trend led to the emergence of restaurants that solely operate through online platforms, without physical dine-in locations. These are known as "cloud kitchens." Cloud kitchens save on prime real estate costs since they cater exclusively to online orders and can run multiple brands from the same kitchen space.

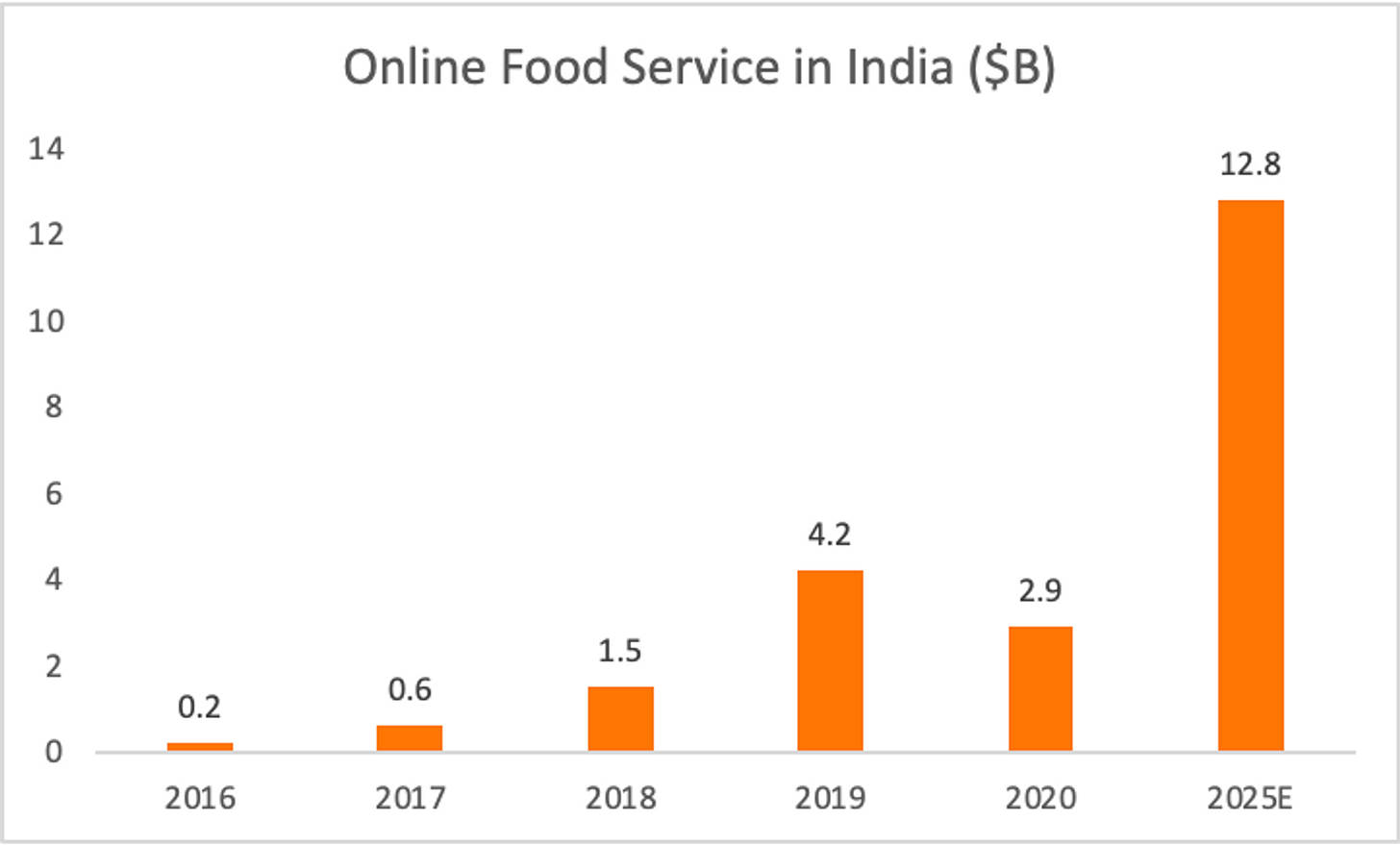

India's food delivery market, valued at $4.2 billion in 2019, has surged to $5.3 billion in 2022. It is projected to experience remarkable growth, potentially reaching $30 billion within the next 5 to 7 years.

Challenges in the F&B ecosystem! 🏋️♂️

Under Utilisation 📉

Traditional dine-in restaurants often must establish themselves in high-traffic locations, which come with high rent expenses. In addition to managing the kitchen, they also invest significantly in interior decor. As previously discussed, these factors can strain the sustainability of dine-in restaurants due to lower kitchen and staff utilisation. In fact, it's worth noting that more than 60% of restaurants reportedly close their doors within the first year of operation, primarily due to the challenge of managing operating costs in relation to their earnings. This highlights the promising potential that cloud kitchens offer as an alternative.

Demand Generation 💥

Cloud kitchens, benefiting from reduced capital and operational expenses, indeed face intense competition. However, for small restaurant owners, generating demand can be quite challenging due to various factors. These include the algorithms used by the platforms, the effectiveness of marketing campaigns, and discounts, among other variables.

Supply Chain and Training 🔗📚

Suppose a cloud kitchen owner has successfully established a brand specialising in a particular cuisine. To enhance kitchen utilisation, expanding into another cuisine becomes essential. Moreover, scaling the business from one kitchen to multiple locations is a crucial step in achieving further growth. However, this expansion introduces complexities in the supply chain.

Sourcing ingredients for diverse cuisines becomes a challenge, as does ensuring consistency in taste across different kitchens. Additionally, training staff to maintain standardised quality is imperative. It's worth noting that the high turnover rate among kitchen staff is a prevalent issue within the industry, making consistent training and quality assurance an ongoing concern.

House of brands in cloud kitchen! 🏠🏢

In light of the challenges mentioned earlier, companies like REBEL Foods, Cure Foods, and Biryani By Kilo have emerged as pioneers in the industry. They've successfully established multi-brand cloud kitchens across the country, taking advantage of the opportunity to scale up various brands. For instance, REBEL Foods has grown brands like Faasos, Cure Foods has introduced EatFit. They've leveraged partnerships with platforms like Swiggy and Zomato to expand their reach and cater to the evolving demands of the food delivery market.

The companies mentioned operate under a hub-and-spoke model, where the central kitchen (hub) plays a central role in food preparation. The prepared food is then sent to delivery kitchens (spokes) where it is assembled and heated before reaching the customer. This approach ensures consistent taste across different locations and has effectively addressed many challenges.

However, despite raising hundreds of millions in capital, this model has not been profitable (yet). This is because companies must invest substantial capital in establishing and operating multiple delivery kitchens (spokes) across the country. While it solves many issues, the initial investment and ongoing operational costs have presented challenges in achieving significant profitability thus far.

Why we invested in Dil Foods? ❤️ 🍲

Introducing Dil Foods, a dynamic food-tech company specializing in creating virtual food brands. These brands are distributed through popular food aggregator platforms like Swiggy and Zomato. At V3 Ventures, we recently led Dil Foods’ fundraise of $2M, alongside Mount Judi.

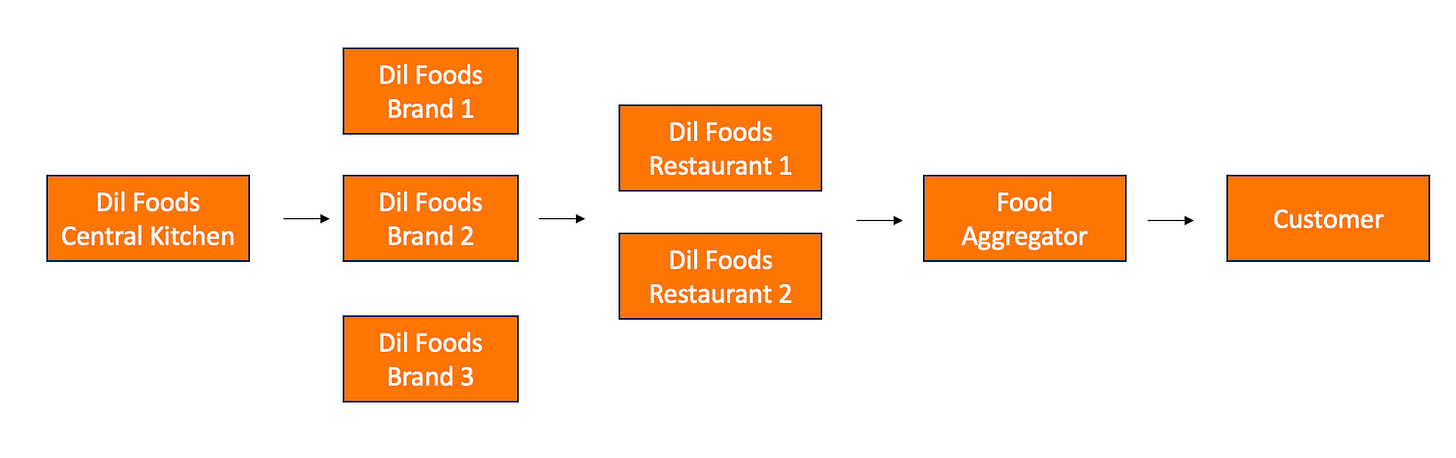

Dil Foods builds amazing food brands across cuisines and produces the food in the central kitchen facility (hub)- pre-fabricated food. It partners with small restaurants (spoke) which serve as local hubs to deliver these cuisines through food aggregator platforms.

Arpita, founder of Dil Foods 👩💼

With two years at Swiggy, she understands the challenges faced by small restaurant owners trying to use food aggregator platforms. Before Dil Foods, she started Nutnbolt to help small restaurants build an online presence and grow their cloud kitchen business on Swiggy and Zomato.

After accumulating extensive experience in this field, Arpita decided to establish Dil Foods. Her approach is highly analytical, focusing on the strategic creation of food brands and empowering small restaurants to enhance their operational efficiency. This is made possible through a robust supply chain and sustainable economic practices.

Win-Win 🏆🤝

Dil Foods operates a highly capital-efficient model by collaborating with existing restaurants (spokes) rather than setting up new kitchens. This partnership benefits restaurant partners by generating additional revenue without requiring extra investments in capital expenditure or additional staff. It's a win-win scenario for both parties involved.

Food Quality is top priority 🌟👨🍳

In the hub-and-spoke model, maintaining consistent food quality across locations is paramount. The central kitchen prepares food with a high shelf-life, minimizing the preparation required by the restaurant partner's staff at the spoke level. This streamlined process reduces the potential for errors and ensures a uniform taste experience across all locations, while also simplifying operations for the restaurant partner.

Scale Up 🚀

In just one year of operating without external funding, Dil Foods has successfully introduced 8 brands and established partnerships with over 50 restaurants. With their asset-light strategy and strong emphasis on food innovation, we are confident that Dil Foods can continue to expand rapidly in a sustainable manner.

Here are some notable observations from the Chinese market, where dynamic developments in food innovation and business models are taking place!

Pre-fabricated meal market in China 🍱🇨🇳

The pre-fabricated meal market in China is experiencing significant transformation due to the rapid growth of the food industry. Cost reduction and enhanced efficiency have become paramount concerns, driving the widespread adoption of the hub-and-spoke model. Central kitchens have evolved to a point of maturity, streamlining various processes such as raw material procurement and food processing, previously handled at the spoke level. This strategic shift reduces reliance on skilled chefs and kitchen staff, leading to decreased kitchen space requirements and subsequently lowering labor and rental expenses.

In early 2023, the Chinese government emphasised the importance of elevating standardisation and regulatory measures, particularly in areas like pre-cut vegetables and central kitchens, while actively fostering the development of the pre-fabricated meal industry. Presently, more than 74% of chain restaurant brands in China have established their own central kitchens, while approximately 60% of restaurant brands are embarking on the utilisation of pre-fabricated meal ingredients.

The pre-fabricated meal market in China is approximately $85 billion, with an estimated compound annual growth rate of 13% over the next five years.

Central Kitchen & Chain Stores 🏢🍲

Taking Haidilao as an example, it's a popular Chinese hotpot restaurant chain with 1,371 stores across China.

Haidilao collaborates with Shuhai Supply Chain for ingredient pre-processing and production across all its restaurants. It hase established central kitchens and cold-chain logistics centers in multiple locations to ensure efficient ingredient distribution, granting Haidilao significant purchasing power and cost control capabilities.

Pre-frabricated meals going Omnichannel 🍱📊

Previously, the development of pre-fabricated meals mainly targeted B2B sales. However, the pandemic brought about dine-in restrictions, compelling restaurants to provide pre-fabricated meal options. Customers began ordering pre-assembled ingredients from delivery platforms, reheating and assembling them at home. This not only helped reduce losses from dine-in closures but also introduced a fresh revenue stream. As a result, consumer demand for pre-fabricated meals surged, reshaping dining habits.

Alongside pandemic-induced changes in consumer behavior, shifts in population demographics and household structures have also played a significant role. There is a growing number of single-person and two-person households, along with increased female labor participation. These factors have generated a rising need for convenient dining solutions. Pre-fabricated meals efficiently cater to this trend by offering complex dishes tailored to smaller family sizes.

Furthermore, compared to regular takeout and traditional fast food, major pre-fabricated meal companies prioritise quality control. They ensure the production of safer and healthier products that align with consumer preferences, further fuelling the demand for this convenient dining option.

Weizhixiang Food- Market Leader 👑

Weizhixiang Food, a prominent player in the pre-fabricated meal market, boasts revenue exceeding $100 million. They offer a wide array of over 300 SKUs!

By the year 2022, Weizhixiang Food has established an extensive network comprising 1,695 franchise stores, 705 retail outlets, and 442 wholesale clients. Their retail distribution channels are strategically concentrated in various regional markets, ensuring proximity to consumers. Meanwhile, their wholesale channels primarily cater to hotels, restaurants, local kitchens, and cafeterias.

Furthermore, the company has expanded its reach into the online sales sphere through Taobao (Alibaba) and JD, which are leading e-commerce platforms in China.

With plans to enhance their production capacity, Weizhixiang Food is set to diversify its retail channels by establishing street-side stores and shop-in-shop setups within supermarkets. This strategic move aims to broaden their market presence and accessibility to consumers.

Observing this trend, can this lead to opportunities for companies like Dil Foods to expand into horeca and omni-channel retail? If you’re building something exciting in food- would love to hear from you! Write to me- rahul@v3.ventures

Loved this! I remember doing. A deep dive on Rebel Foods a couple years back so cool so see such an in-depth dive on the industry now!