Quick-commerce in China 🥬🥩 🛒🇨🇳

Ding Dong Mai Cai and Miss Fresh were the poster kids of grocery quick commerce in China. Lately, Miss Fresh has been struggling. What does this mean for the quick commerce boom in India and beyond?

Welcome to Old Rope. I write on emerging trends from the East! 🌏 Subscribe to stay updated.

China’s $1.8T fresh product [F&V, Meat] and grocery market used to be very attractive for entrepreneurs and investors, with billions of dollars invested in the last 5-7 years. Given the internet penetration, it is estimated that one out of ten households in China purchases grocery online.

However, one of the largest companies in this space has recently been winding up- which poses a big question to the thesis of e-commerce for fresh produce and groceries coupled with quick commerce.

Mei Ri You Xuan/ Miss Fresh [每日优选]

Started in 2015, Miss Fresh proclaims to be the inventor of the distributed mini warehouse [DMW] model- an approach where fulfilment and distribution of goods happens from multiple smaller, strategically located warehouses instead of a few large warehouses. By March 2021, Miss Fresh opened up 631 mini warehouses across 16 cities in China and was able to deliver fresh produce and FMCG products within 39 minutes on an average.

Intense competition and failing unit economics!⛷️

Due to intense competition fuelled by immense capital, delivery time came down from 120 mins in 2015 to 39 mins in 2021- free for the customer!

The fulfilment expenses, gross margins and marketing expenses have not improved enough for the business to be sustainable!

Sloppy IPO! 🥴

Miss Fresh raised over $1.7B from the top tier investors such as Tiger Global, Tencent, etc. and then went public in June 2021- raising $273M and valued at ~$2.5B- which was very underwhelming given its last private round was at a much higher valuation.

Ding Dong Mai Cai [叮咚买菜】

Competing toe to toe with Miss Fresh- Ding Dong Mai Cai [DDMC]- founded in 2017, focusing in fast delivery of fresh produce and expanded to daily groceries- targeting to deliver within 30 minutes. Surprisingly, it reported profitable Q2 2022- with around 1000 mini warehouses doing fulfilment.

DDMC has shown ‘some’ improvement in unit economics 🐌

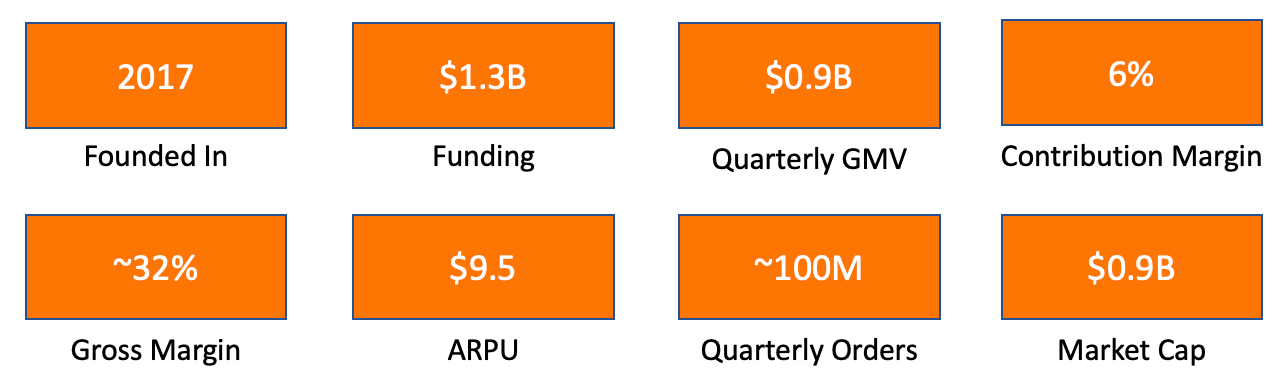

DDMC has raised over $1.3B, with the public listing valuing the company at $6.6B in June’21- which has come down to less than $1B today.

As we can see above, DDMC has demonstrated improvement in gross margins as well as reduction in fulfilment and marketing costs, translating to first profitable quarter. PS: It had to raise $1.3B+ and reach a scale of ~$1B+ worth of orders every quarter to demonstrate profitability. Even after this, the company is valued at $930M [1/6th of its listing valuation].

Unit Economics of a high performing warehouse for DDMC 📦

What worked well for DDMC? ✨

Over time, DDMC has shut down its non-performing warehouses which has reduced the overall rental and maintenance costs. Further, with increase in GMV, the utilisation rate has improved leading to reduction in overall fulfilment costs.

Due to the slow down of other players like Miss Fresh, DDMC got an opportunity to increase revenue with marketing expense decreasing- hence capturing more marketshare efficiently- last man standing!

Product mix has a strong impact on the gross margin- as DDMC has focused on fresh product where greater margin pool is available, than just FMCG items.

The jury is still out on DDMC as it is yet to demonstrate continued sustainable economics while growing steadily.

Learnings for India and SEA! 🇮🇳🇮🇩🇻🇳

Quick commerce is a very exciting proposition for the customers but it’s also fuelled by discounts and subsidised deliveries. It’s interesting to see that customers are only loyal to prices and delivery time- so it boils down to the VC funding available to burn in order to achieve both. It’s the race to the last company standing…

To sustain the economics, it will be important for companies to improve supply chain and move towards fresh over FMCG so that the gross margins could be healthier.

Investors who are paying 3-5 times of GMV should look at China market comps and note that the largest player in China is valued at 0.3 times GMV!

Always up for feedback and chat here- rahul@oldrope.club