Online Matchmaking & Dating- Around the world and India! 👩❤️👨🌎🇮🇳

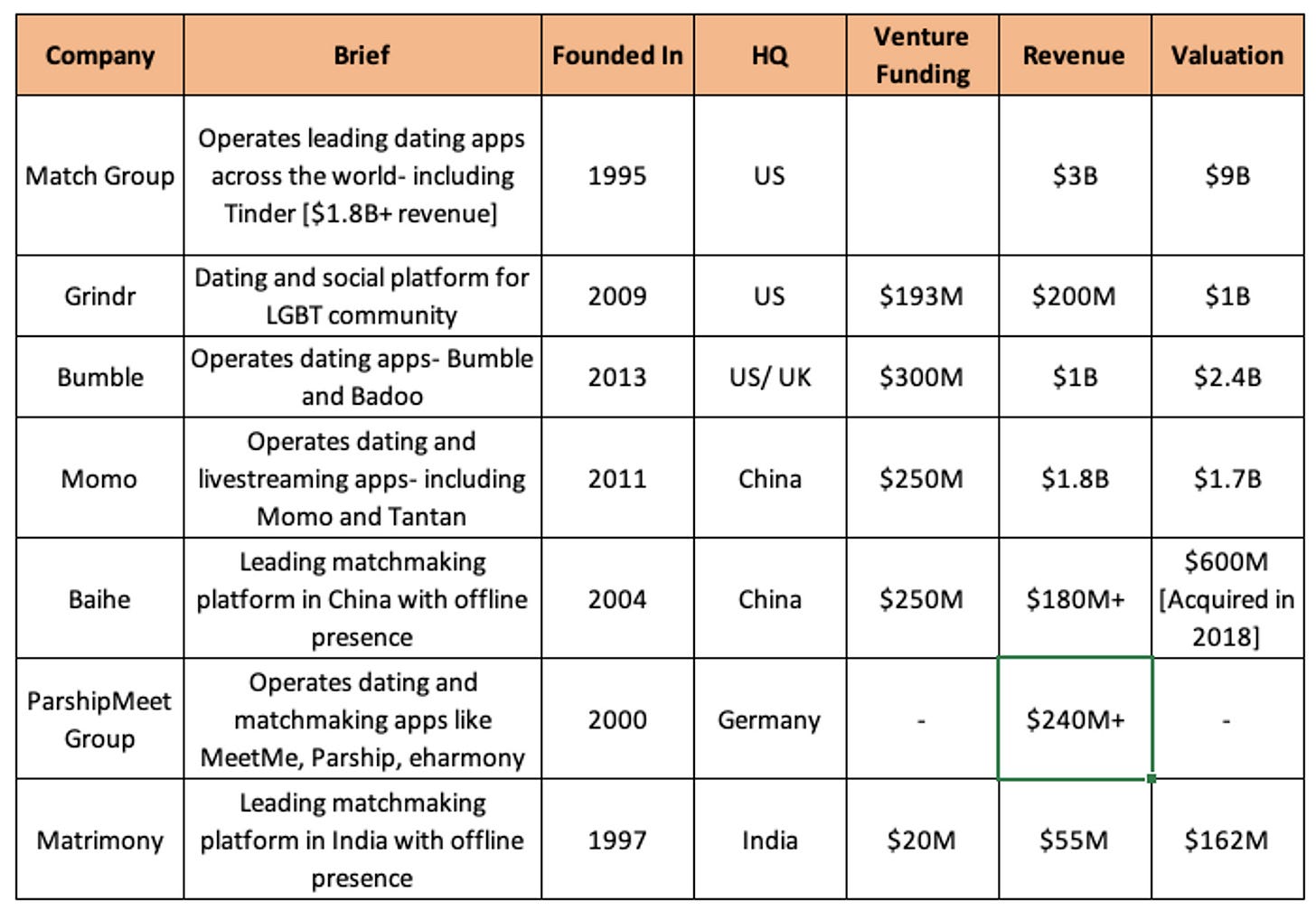

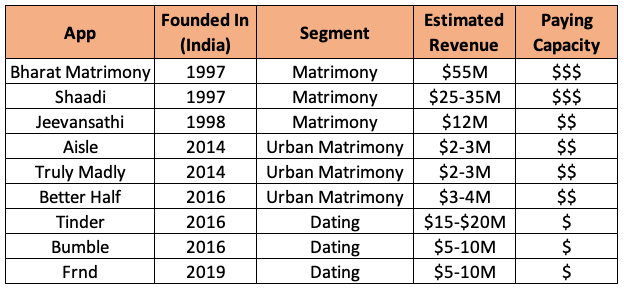

Several billion dollar companies operate in $7B online dating market across the globe. Surprisingly- India's wedding industry is extravagant but online matchmaking is ~$300M. Let's find out more

Welcome to Old Rope. I write on emerging trends from the East [sometimes West]! 🌏 Subscribe to stay updated.

Over the last few months, I have been receiving pitches from several startups in India and SEA- building in online dating and matchmaking space. I have always wanted to write about the space but found an excuse to delay it. However, witnessing the growing number of founders venturing into this field has convinced me that the time is ripe to finally delve into it.

For those of you who don’t know- I spent over 6 years working with dating and matchmaking startups based in US, SEA and China. Last, I was working with Tantan for internationalision (2017-2020), one of the largest dating apps in the world- which got acquired by a Chinese social network- Momo for ~$800M.

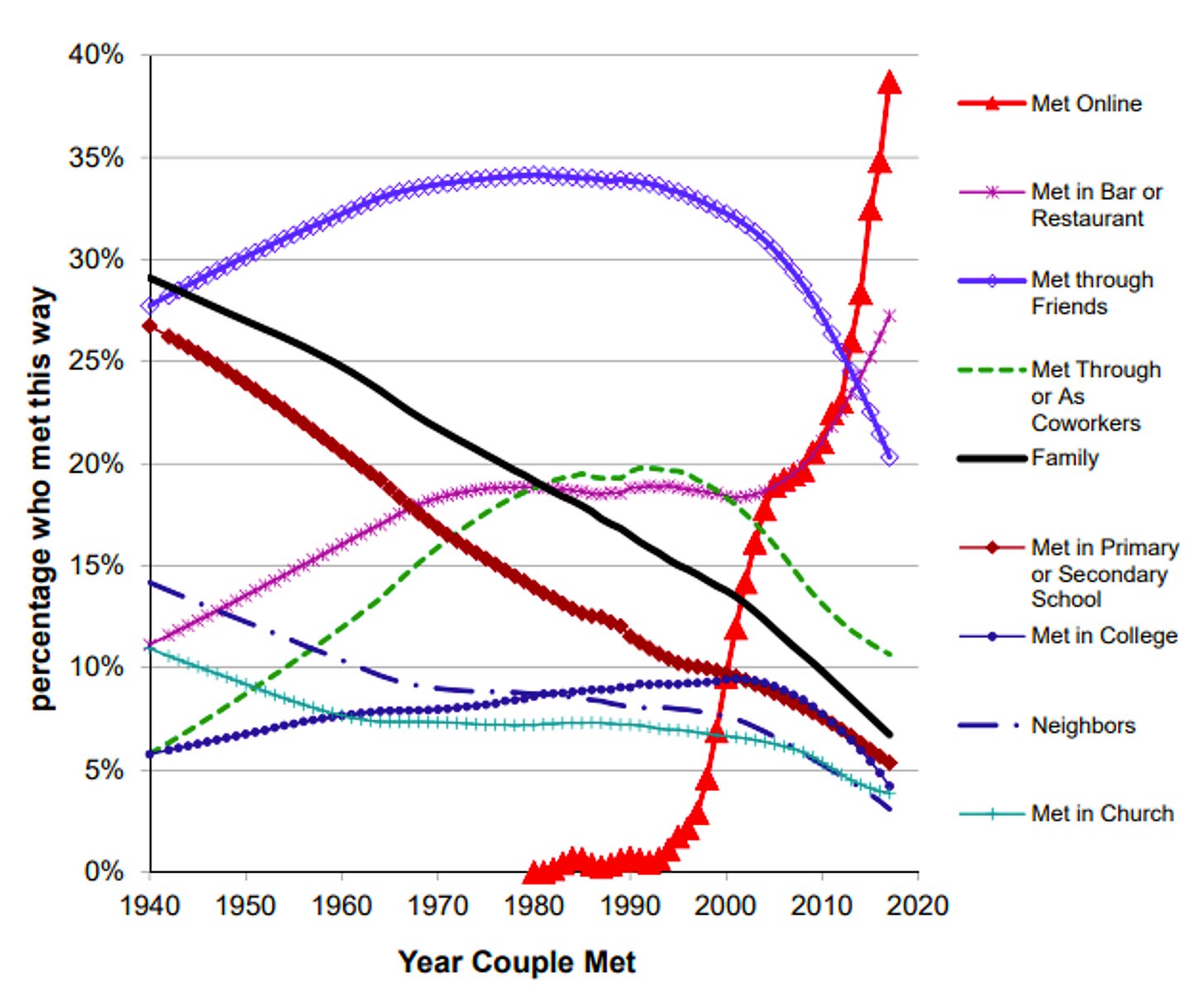

Before the advent of online matchmaking, individuals mainly relied on traditional offline ways of meeting other individuals seeking romantic relationships- matchmaking agencies, social events, family, classified ads etc. There were two key challenges- double co-incidence of needs [whether the other person was looking for a relationship] and limited pool of individuals.

Genesis of Online Dating💻💑

The above challenges created need for a 2 sided online marketplace- where individuals could create a profile and look for matches based on their preferences. One of the earliest examples of online dating platforms was Match.com, which launched in 1995.

Match.com became a success story, reaching over 100K users in first six months, and they moved from an advertisement led business model to a monthly subscription based model.

Until 2000s

Match.com became popular- got acquired by IAC for $50M in 1998

eHarmony was launched in 2000- using a proprietary matching system developed to match highly compatible singles. eHarmony’s matching technology utilizes a lengthy questionnaire, which originally was in excess of 450 questions but since then it has been reduced to about 150.

2000-2004

Friendster started in 2002, as a social networking platform- connecting friends as well as strangers. One of the key use cases was online dating

Plenty of Fish, launched in 2003- being a free dating platform, whereas other dating apps were paid- aided its success.

2005-2009

Seeking Arrangement, launched in 2006, focused on niche space for sugar dating- charging high membership fees [~$70pm]

Grindr, launched in 2009- as a location based dating app for the LGBTQ community- and eventually became the most successful dating platform within the community.

2010-2014

Tinder, launched in 2012, as a location based dating app- with the swipe left or right feature- making it a viral game. Users are shown photos of nearby potential matches and can swipe right to “like” and left for “nope.”

Hinge, started in 2013, differentiated itself by claiming to be less superficial- by emphasizing on uploading user-generated content in formats, such as photos, videos, and prompts as a way to express personality and appearance.

Bumble, was founded in 2014- by Whitney Wolfe, after she left Tinder. Bumble was similar to Tinder as it was also a location-based dating app, but there was one key difference: Women had to make the first move.

Okay…enough of dating apps. Seems like it is a very crowded market, with companies essentially attempting the same thing but with slight variations in their positioning. Still, there are several new apps which are launched every year and are able to attract venture capital!

The global market for online dating and matchmaking is expected to be around ~$7.8B in 2023- growing at a slow pace from here on; given that US contributes for more than 30% of the revenue and it’s reaching saturation. The new dating apps will have to displace existing apps in order to become large companies!

Leading players across the world!🌍

Match- the big daddy of dating! 👨👧👦

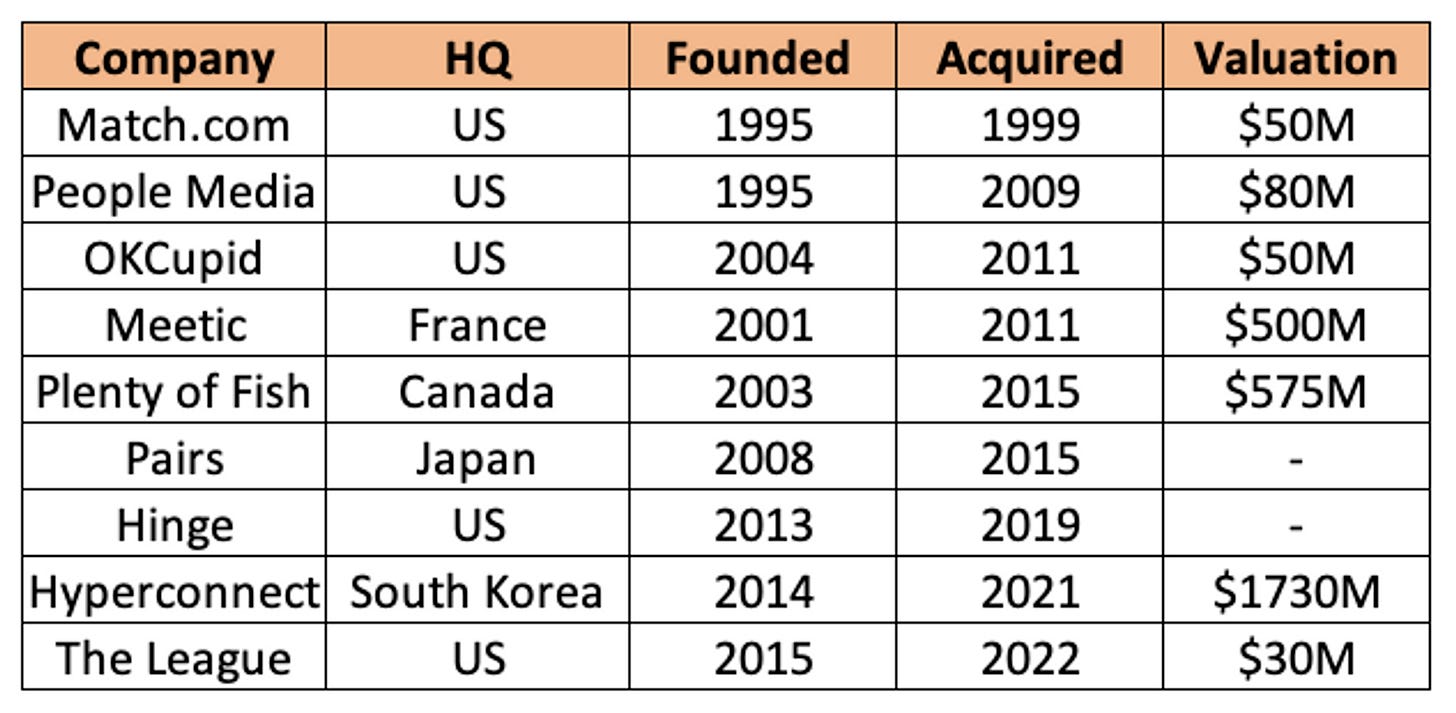

Now-a-days, dating apps start with the vision of finding home in Match’s portfolio. Match.com runs more than 45 brands- and you will find leading players like Tinder, Hinge, OKCupid, etc. competing with each other, but the dollar ultimately is going to MATCH!

In 1999, Match.com was acquired by IAC- a media conglomerate based in US. In end of 2019, IAC decided to spin off all the online dating brands under Match Group.

Tinder was incubated within IAC- and drives ~60% of the revenue of Match group today! It’s very evident from Match Group’s strategy that overtime- older brands become less relevant, hence it’s important to keep trying with newer formats and acquiring companies which could have potential in the future to overtake Tinder.

Just as a case in point, Hinge positioned itself as an anti-tinder app, but it’s actually the same company. Who knows, 10 years later- Hinge brings in a lot more dollar than Tinder.

The dating paradox! 🤔

One of the key challenges dating and matchmaking apps face is user retention. The sooner you find a match- the better is the experience- and the user would happily uninstall the app. If the user is unable to find the matches- then the user would angrily uninstall the app. Maybe low retention could be one of the key reasons for low revenue multiples- 3-5X [as seen in the chart above].

Moreover, meeting matches online in asian countries is a taboo- so dating apps might not experience strong word of mouth, in spite of great experience.

So, it’s very important to discover the cost of user acquisition- and charge the membership fees such that LTV/CAC makes logical sense.

Globalisation! 🌐

One of the key advantages of matchmaking and dating platforms is the ability to go global! Just like any social network [Facebook, Snapchat, etc.]- dating apps are 2 sided marketplaces, which need to localise marketing efforts in order to capture other global markets.

But- there is a lot more to localisation than just branding and marketing. It also calls for product features and algorithms which are tailored to the culture and demographics of a certain market. What has worked in the US might not work in India?

…this seems like a good segue into our next topic of discussion: Dating and matchmaking in Indian market!

India’s matchmaking and dating market 🇮🇳

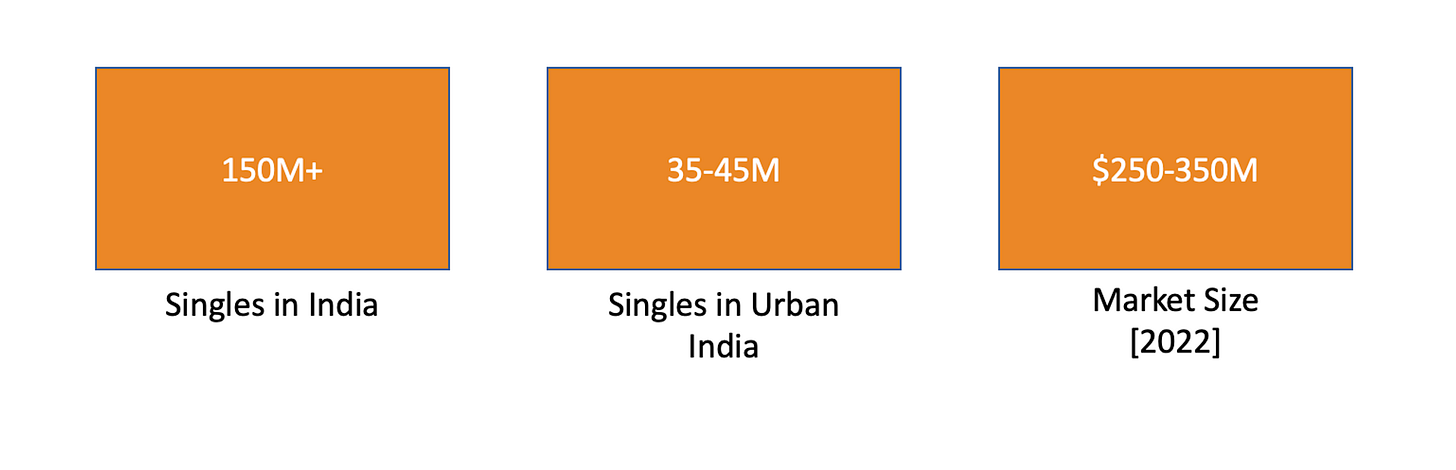

Given the size of the population, Indian dating and matchmaking market seems very attractive! With over 35-45M singles in urban India, it is one of the largest markets in dating [in terms of users]. But the revenue of dating and matchmaking apps has been in the range of $250-350M, much lower than the western markets.

Dating vs Matrimony 💑👰

In the Indian context, the term ‘dating’ typically refers to the process of finding a boyfriend or girlfriend, while ‘matrimony’ is associated with seeking a husband or wife. Matrimony involves active family involvement, whereas dating is often pursued more discreetly. Interestingly, there are less female users using dating apps, compared to matrimony apps.

Arranged marriage, which is the prevailing approach to matchmaking in India, involves utilizing matrimony platforms, family networks, or offline matchmakers to find a suitable spouse. This process usually results in a relatively shorter time between finding the match and the wedding ceremony. It is common for families to prefer matches within the same caste.

In urban areas, there is a growing trend of individuals marrying their boyfriends or girlfriends whom they initially met through dating apps, but still early days!

Matrimony or Dating? 🌹💍

Indian online matrimony industry started in 1997- with Bharat Matrimony, followed by players like Shaadi.com and Jeevansaathi. They provided opportunity to singles [and their families] to look for a match based on filters like caste, region, horoscope, etc. Initially these platforms were used by parents- who would manage their children’s profile- whereas now the positioning is evolving so that some of these profiles are managed by end users.

10 years old Ad- Father is actively involved in finding a match for her daughter

1 year old Ad- Individuals are managing their own matchmaking process

Dating apps started in India around 2014-15- with companies like Woo and Truly Madly- as they raised venture capital hinged on success of Tinder. These companies positioned themselves as casual dating apps and targeted younger audiences.

Seeing the advent of dating apps in India, Tinder set up its base in India in 2016 by setting up local team in the capital city. Tinder’s app was most evolved to take over the Indian market and they went quite big on branding and marketing.

In spite of sincere efforts from the local apps, they spent the marketing dollars to educate users how to use tinder! Then we saw dating apps like Happn [HQ Paris], Bumble [HQ US], Hinge [HQ US], Tantan [HQ China] also launch into the Indian market.

Even after spending big bucks on Indian market- the male: female ratio on dating apps is vastly skewed towards men, for e.g. Tinder’s male: female ratio in India being 93:1. This also leads to poor experience for both, male and female users.

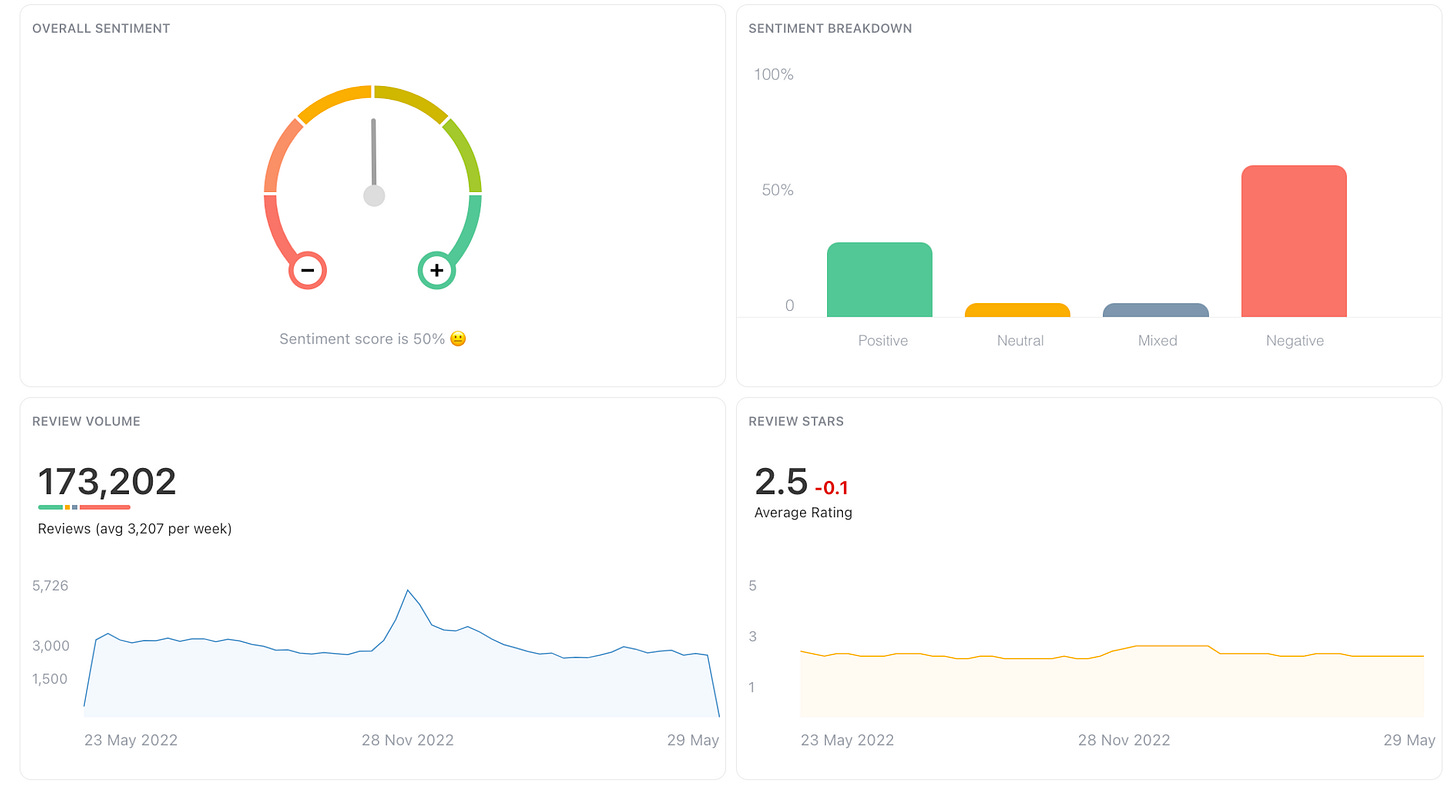

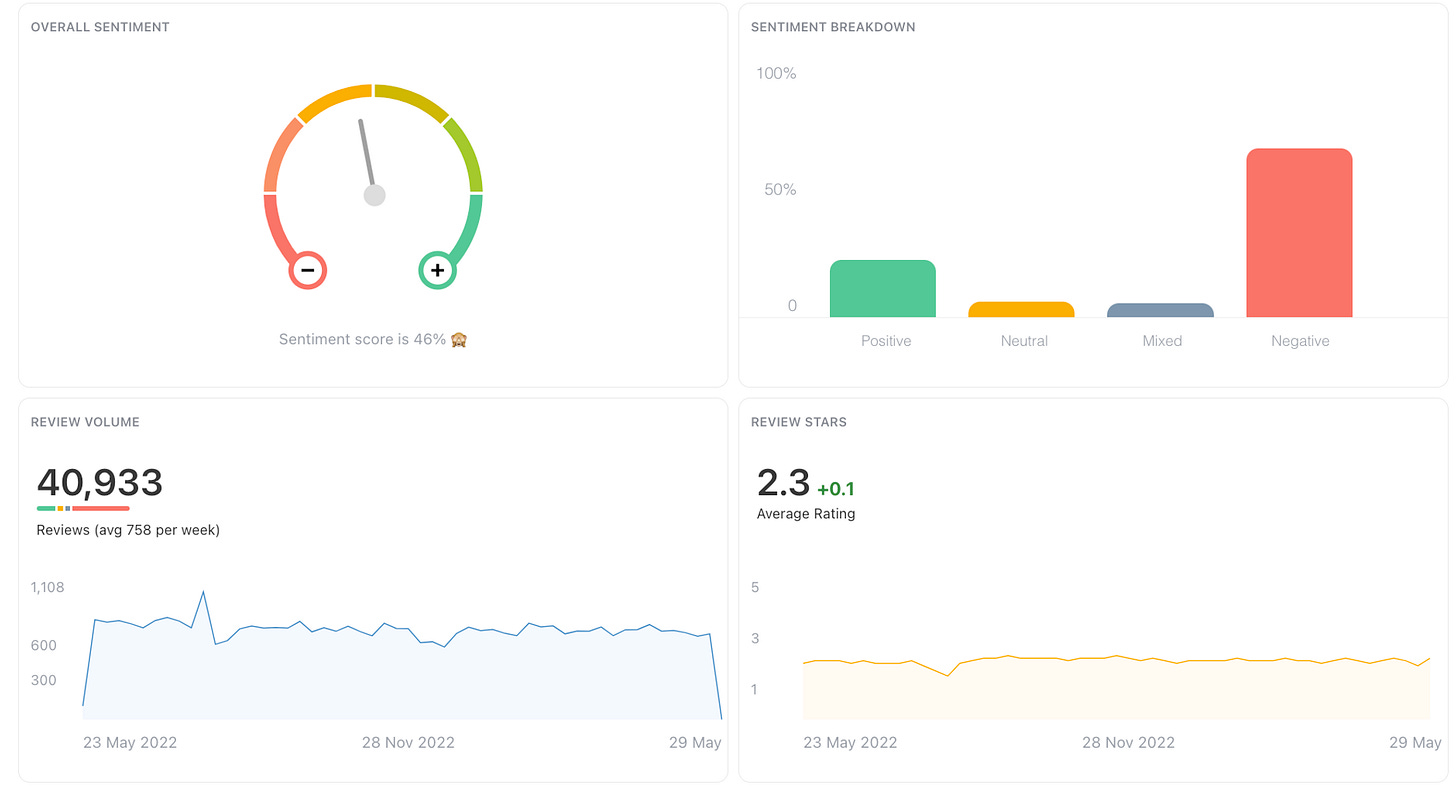

As seen above, the experience is quite bad. Why?

Due to extremely skewed gender ratio, it leads to poor experience for female users as they are swamped with matches- as and when they create a profile

Because of this, the retention for females user is poor and makes it costlier to acquire female users. [At scale, it could shoot up to $5-$10/ user].

Moreover, in India, out of 100 internet users, only 33 are female. This makes it even harder to acquire more female users. [Source]

This also leads to poor experience for male users since they don’t get matches and they go on to give a low rating to the app.

This creates a vicious loop for the dating apps in India!

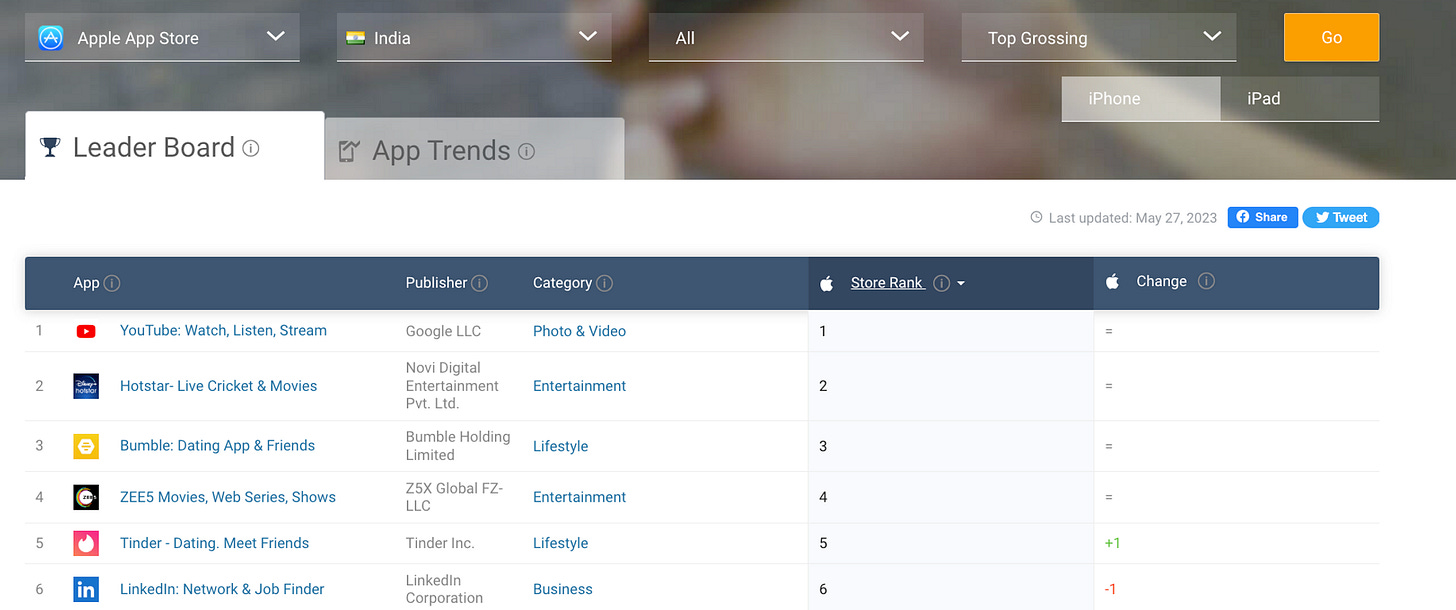

Even after that- Tinder and Bumble have proven to be amongst the highest grossing apps in the country. But is that significant? Let’s explore this a bit later.

The above mentioned dating apps have largely focused on the Tier 1 cities and English speaking population. Often India is referred to as a country- constituting of many countries; since people across different provinces have different culture and speak different languages. Apps like frnd have focused on the tier 2-3 market in India with regional languages at play and audio first approach. It monetises via micro-payments for chatting with dating experts, to send virtual gifts in audio rooms, etc. Early success of frnd has inspired many startup founders to build ‘dating app for Bharat’.

There is another segment of apps belonging to the Urban Matrimony segment- somewhere in the middle of dating and traditional matrimony! Apps like Aisle and Betterhalf have focused on individuals belonging in urban regions and looking to find a date to convert into a potential marriage. Even Trulymadly pivoted into focusing on this niche.

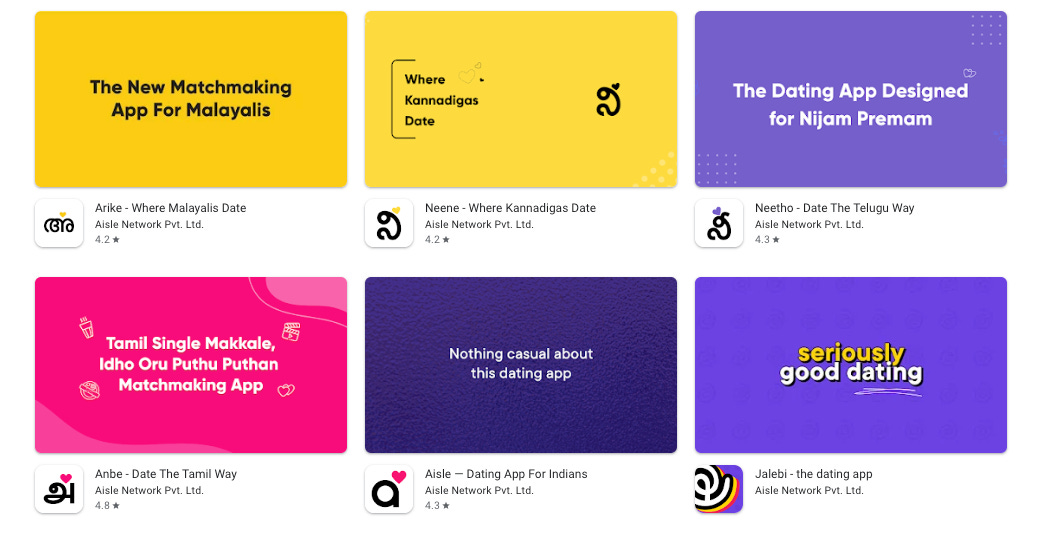

Aisle is taking an interesting approach to regional matchmaking- by creating regional apps. They have already launched 4 regional apps, focusing on Malyali, Telegu, Tamil and Kannadigas.

This seems to be inspired from Bharat Matrimony, which runs platforms like Telegu Matrimony, Tamil Matrimony, Kerala Matrimony, etc.

As mentioned above [grossing charts]- Bumble and Tinder make fraction of their global revenue in India. Given their investments, it seems that both the companies have a long term view on Indian market, waiting for the economy to grow and they can reap dividends of investment today.

Learnings about Indian market! 📚

Even though Indian weddings are known to be extravagant- all over the world, but the largest matchmaking platform in India is a matrimony platform- worth $162M with $55M in revenue [Bharat Matrimony]. Dating apps in India haven’t been able to grow as much, some of which can be attributed to the Indian culture. How will this evolve? Going forward, I believe matrimony industry will expand further in the near future as we see more individuals going to the internet to look for potential partners. Dating industry could pick up as well- but I feel that it would take more time since it depends on cultural evolution and systemic shifts in society. Incase one really wants to build a dating app- going global could be the way to solve for market size!

New age matchmaking platforms often find a chicken-egg situation while signing up male users and female users, especially during the cold start phase. My advice would be to onboard high quality male users during the initial period of launch and then onboard female users. Usually female users don’t find good quality matches on other platforms and tend to drop off soon. If the retention for female users is solved, it could solve for the overall growth of the app- during the cold start.

For global platforms to find success in India, it will be important to adopt to cultural nuances in the market. With Hinge, Match group [also owns Tinder] is trying to solve for the urban matrimony use-case. Also, there are rumors about Match group discussing strategic investment in Shaadi.com- leading matrimony platform in India.

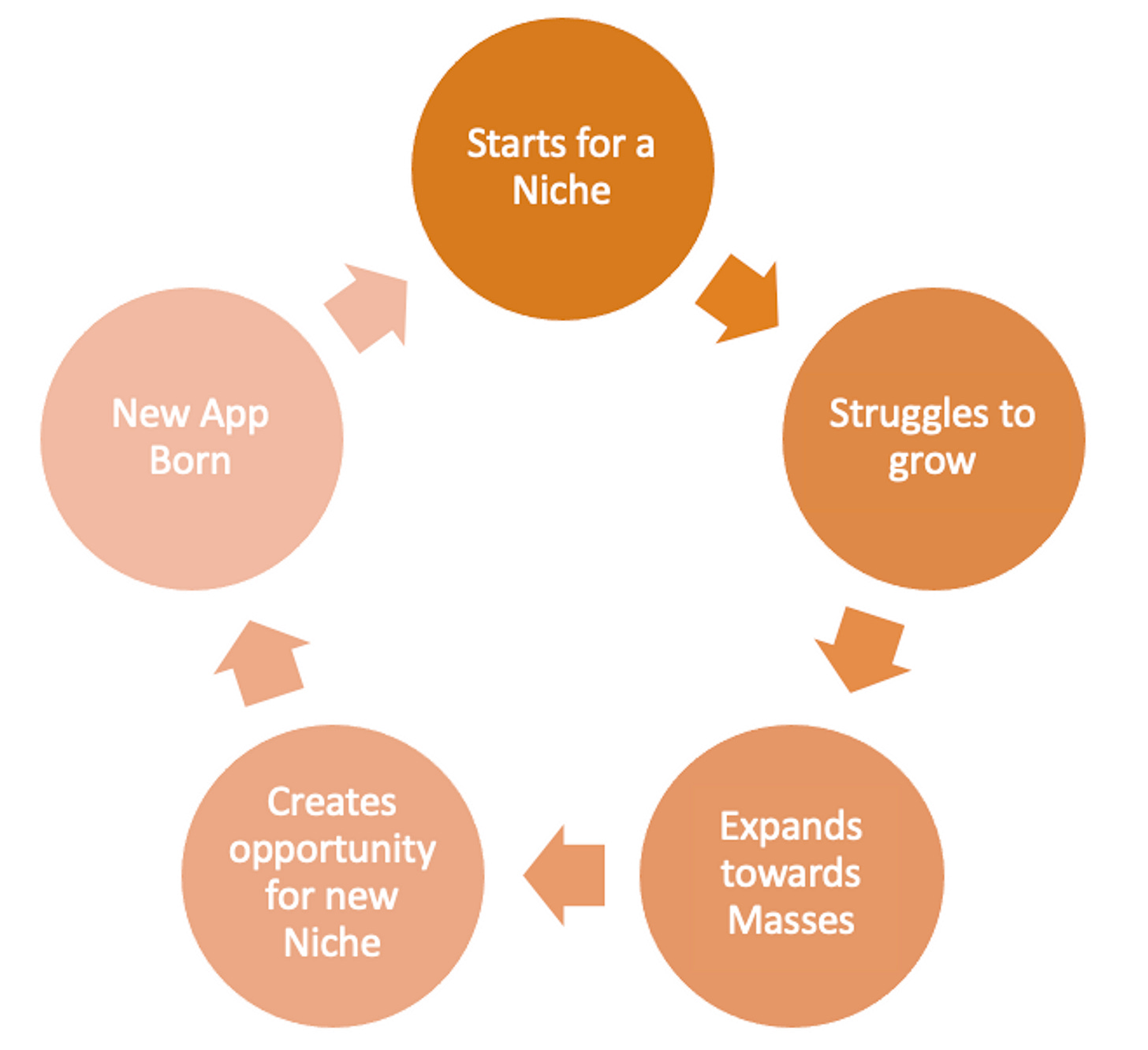

Food for thought: The circle of life of dating apps! 🔄

Dating apps is a funny business. Most of them are solving for the same thing- but still are able to co-exist. Although, it’s interesting to see the evolution of a dating app, which is applicable to most of the products. For example:

Tinder started as a dating app for university students [niche] looking to find date with attractive partner

Since the student market is not large enough, and hard to monetize- Tinder needed to find more avenues to grow.

Eventually, Tinder became a mass app- catering to individuals looking for casual relationships.

As Tinder became a mass-app, it created opportunity for apps like Hinge, with positioning around serious relationships [new niche]

If Hinge finds it hard to grow in the niche, it might as well move towards a mass approach. Well, it has already been acquired by the big daddy- MATCH group!

Happy to chat with founders and operators building social networks and brainstorm! You can reach me here- rahul@oldrope.club