Negative Working Capital Fallacy – VIP Peilian’s fall! 📉

Consumer facing education companies collect payments upfront to teach (service) over a period of time. Promises of refund creates liabilities, which if not managed carefully, can create trouble.

Welcome to Old Rope. I write on emerging trends from the East! 🌏 Subscribe to stay updated.

As we enter the bear market, there is a lot of talk around 'cash flow positivity' - a term is prone to abuse. In EdTech, companies collect money upfront for a service delivered over time. In fact, this ‘negative working capital cycle’ is an ideal situation for any business. However, when companies over-optimise on this cycle, the advantage can backfire.

Eg.: A buys a guitar live learning course of 6 months for $600, where A attends one class per week and the teacher gets paid $10 per class. For the first month, the cash collected is $600 against $40 payments towards the teacher. Now, if the company spends remaining $560 on marketing…how will it pay for the teacher's compensation for the remaining 5 months? We have a case-in-point: VIP Peilian’s owner XiaoYinKa.

VIP Peilian and XiaoYinKa [VIP 陪练和小音咖] 🎹

VIP Peilian was one of the largest live tutoring platform for music in China, having raised over $165M and reached $360M revenue run-rate. I had covered it here:

In April ‘22, VIP Peilian was acquired by XiaoYinKa Group, one of the largest offline platforms for music learning for children aged 4-16, to build the largest O2O platform for music education.

While music education did not face adverse impact of China’s double reduction policy for after-school tutoring, general investor interest in online education became scarce. This created challenges for VIP Peilian growth.

Due to the pandemic and China’s 0 covid policy, growth became a challenge over the last 2 years for XiaoYinKa Group as well. Hence, acquiring VIP Peilian to form a stronger group company made sense for XiaoYinKa, for capitalising on building the strongest O2O brand in the country.

XiaoYinKa students left stranded 🎓

In June ’22, the news broke out that XiaoYinKa had been unable to pay its teachers for months, leading to the company being unable to fulfil the classes for which students/ parents had already paid. Consequently, parents started asking for refunds, only to find out that the company is unable to honour the promise of refunds as well. As on date, it owes ~$90M to parents!

What went wrong? 🫠

XiaoYinKa was charging customers $30/class and paying teachers $37/ class in order to gain market share. Also, by giving excessive discount on class pricing, they were incentivising parents to buy more classes at once. This increased their collection revenue upfront, which allowed them to sustain teacher payouts, but meant that at some point they would need outside investment if the cash collected is less than the payouts for that month. As the XiaoYinKa group could not raise external capital to resolve this issue, it got trapped.

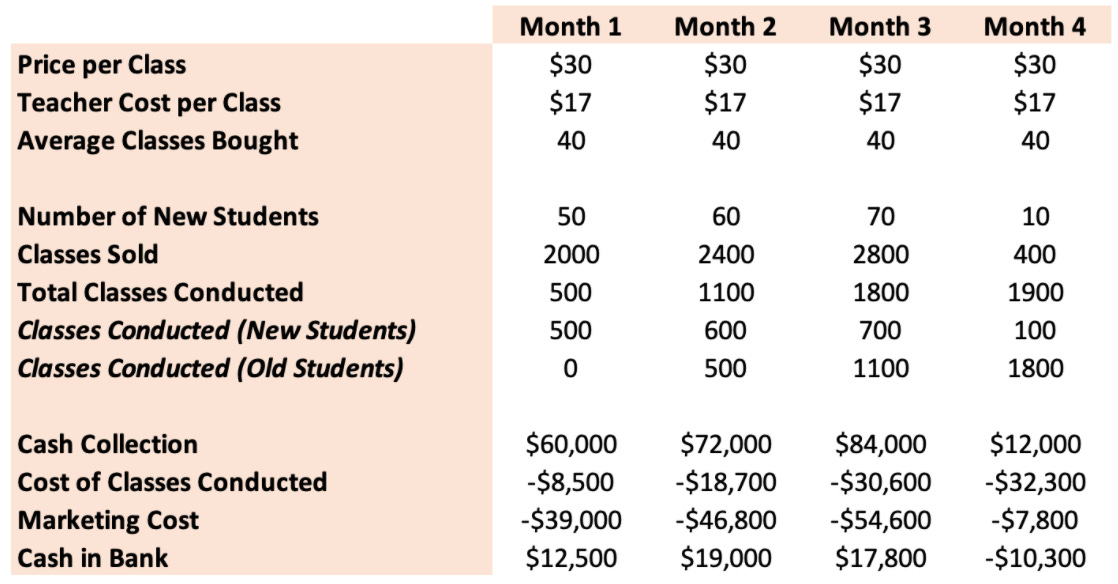

Here is a simulation of what likely happened:

Let’s imagine that an average package is of 40 classes (1:1) with customers paying up $30 per class and teachers receiving $37 per class - seems counterintuitive. As the company is adding more students, it’s bringing in cash which is helping company fund the teacher payment and marketing (30% of collection). Trouble comes up when new user acquisition takes a hit and there is no external source of funding, but the classes from previous cohorts have to be conducted, even as the company does not have enough money in the bank to fund the operations.

General problem in Education! 😶🌫️

While the above may seem an unusual case, where the teacher cost per class is higher than the price of the class, but this is just another marketing tactic. Several other companies in education are spending more on marketing (say 65% of collection). Here is an adjusted version of Simulation 1, with varied ‘Teacher Cost per Class’ and ‘Marketing Cost’:

Companies are using the money they owe teachers (or other variable costs) to fund growth, a system that could collapse if the growth hits a standstill. This creates a vicious cycle, where if teachers aren’t paid in time, they would not deliver the classes, which would further lead to students asking for refunds.

This can only be solved with external funding and/or improvement in the future marketing costs - both of which are not working in EdTech’s favour currently.

Emergency fund to the rescue! 🏥

It should become a practice for companies to create an exigency fund for situations where they could run out of cash to process future liabilities. To maintain discipline in business, companies could potentially set out the future teacher payments (liabilities) in another fund, so it is not used in other activities such as marketing, operations; and in the event of slowdown in business, teacher’s salaries (or other variable costs) are not compromised.

Lots to Learn for B2C EdTech Players, Investors and Regulators! 🤓

Uncertain environment calls for business discipline as EdTech sector is going through adjustments and investors are also waiting and watching to arrive at the new normal. In turbulent times, companies must ensure highest degree of business discipline, which entails focusing on unit economics, optimising on marketing spend, and being cautious about accounting practices. Future growth should not happen by compromising on present.

Don’t treat cash collected like revenue.

It is a blessing in disguise that most of the direct to customer EdTech companies have upfront collection of cash for service which has to be delivered in future. Sometimes companies treat this cash like revenue [though accrued revenue is much lower], which could lead to ignorance on spending.It would be ideal if accrued revenue is calculated correctly [according to services rendered] and the focus is always to increase accrued revenue and achieve EBITDA level profitability, instead of just focusing on cash flow. Auditors should also be careful in the similar manner.

Regulators could step in!

It would not be surprising that regulators step in and create policies to avoid cases of default - for teachers as well as students. Given that it is hard earned money of parents, companies should not use this money in a negligent way.In China, there is regulation where educational institutes have to sign custody agreement with a bank to open a special account for prepaid funds - the prepaid account should be separated from their daily operation account. Bank will allocate funds to the institutes according to the progress of service delivered. In case of abnormal suspension of the institute, the tuition fees of the students can be fully refunded from the bank, ensuring the interests of the trainees and their parents to the maximum extent.

“It may sound strange, but many champions are made champions by setbacks.” — Bob Richards

Would love to hear back on your thoughts! You can write to me here: rahul@oldrope.club

Shout out to my friend- Zhang Xintong for the insights from China!