How China's Coffee Revolution Can Inspire India's 🇨🇳 🇮🇳

The two most populous countries in the world are also two of the biggest tea drinkers. But China's coffee market is exploding, and fresh coffee is growing the fastest. Could India be next?

Welcome to Old Rope. I write on emerging trends from the East [sometimes West]! 🌏 Subscribe to stay updated.

My Indian parents need a hot cup of masala tea to start their day, and the practice has continued from our forefathers, even though there have been some modifications in the taste. This would be true for most Indians - with only a small percentage graduating to coffee. India’s per capita tea consumption is 475 cups per year whereas it is only 16 cups for coffee. That being said, the great Indian middle class is moving towards coffee as an indulgence, causing the coffee market to grow rapidly in the country ($1.6B; growing 10% YoY)

While China is different from India (in terms of culture and development) and it’s not fair to compare the two just because of the population size, the two countries share an uncannily similar habit of tea and coffee drinking.

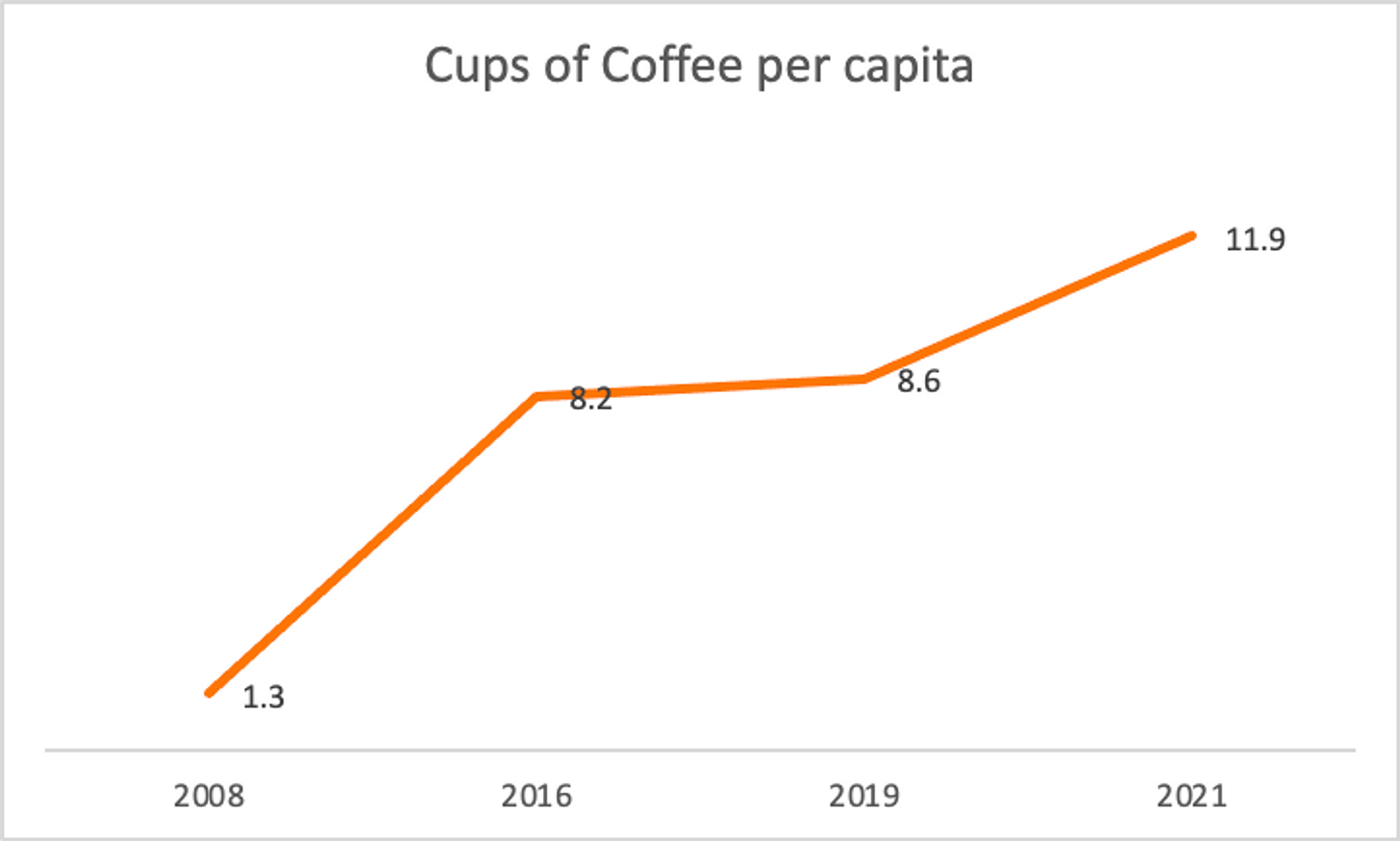

In China, the per capita consumption of coffee is ~12 cups whereas consumption of tea is ~400 cups- indicating a similar gap!

Coffee Market in China ☕ 🇨🇳

China has been pre-dominantly a tea drinking market and has seen several successful retail businesses built around ‘tea’- such as Hey Tea, Naixue, among others. Most of these stores have long queues and waiting time!

Inspite of this, China’s coffee market has evolved deeply on account of the influence of western culture as well as a rising middle class! China’s coffee market is estimated to be around $67B as of 2022 (source) growing 15-20% YoY.

Nestle entered China in 1980s with its instant coffee product and has been instrumental in creating and growing the coffee market. As the middle class in China is rising, it’s evident that the freshly brewed coffee market is growing very fast, with over $20B+ market in 2022!

Supply from Yunnan 🌿

Yunan, a landlocked province in south-west China ranks fourth in Asia and 12th in the world- for coffee production, accounting for 1.5% of the global production. The region currently has the largest coffee planting scale and the largest output in China. The planting area and output accounts for more than 99% of the country's total coffee production. Yunnan mainly grows Arabica coffee, of which Katim is the main variety, which is characterised by strong disease resistance, high yield and good quality.

These characteristics have ensured availability of a strong coffee supply for the country's growing coffee culture.

Starbucks, Western Influence & the Rising Middle Class! 🇺🇸

Starbucks opened its first store in China in 1999, when it was (and still is) majorly a tea drinking market! Over the past 24 years, Starbucks has become the largest coffee chain in China, which is not only because of the growing coffee market but also due to the company's sincere efforts to localise and adapt to the customers in different parts of China. Starbucks has also integrated with WeChat and Alipay for seamless payments and delivery. Within store, you can order from WeChat and get notified as your coffee is ready!

Today Starbucks operates 6000+ stores in China, making it the company's second largest market after the US.

Moreover, Starbucks charges more than 30 RMB (~$4) for its coffee, which is premium, creating wide space for other local and international brands.

Local Coffee Chains!🥤

People in China like to flaunt their Starbucks cup and you would often see them carrying it around. It would be fair to say, it is not for everyone!

“It is true that a Starbucks latte is more expensive in China than in the United States,” - John Culver, president of Starbucks China (2013)

The premium price point of Starbucks created an opportunity for local coffee chains to go after functional use case of coffee at a reasonable price.

Luckin Coffee, started in October 2017, to provide a reasonably priced coffee to the Chinese consumer- increasing the penetration of coffee consumption in the Chinese market. Moreover, the products resembled milk-tea’s taste, which is more acceptable to the Chinese consumer. "Ruixing 瑞幸" is the Chinese name of the brand- it fits the Chinese people's vision of a happy life, which means this coffee could bring good luck!

Luckin Coffee has taken China’s market by storm and given stiff competition to Starbucks. Out of the 9300+ stores, ~67% stores are company owned, whereas remaining are franchise owned. There are several reasons which led to its wild success!

Pricing

As mentioned above, a 475 ml Starbucks latte costs $4 in China, while a 475 ml latte (post discount) costs almost 10 yuan ($1.7) at Luckin. Moreover, Luckin has heavy discounts and offers, hence average price of a cup of Luckin coffee drops to 10–20 yuan ($1.5–3)

The lower price has allowed a wider group of audience to enjoy coffee more as a functional drink, while at the same time building an aspiration brand around it.

Localisation

Luckin Coffee has played an important role in deepening the coffee market in China by introducing products which would suit the Chinese customer like Brown Sugar Boba Latte (陨石拿铁) by combining ingredients of milk tea (Boba and brown sugar) with coffee latte, Newer Latte (creamy milk latte, 厚乳拿铁), etc.

Luckin has also launched its tea brand- Xiao Lu- which is a series of tea drinks based on tea and mixed with milk or milk tea. Given the low price point and localised menu, Luckin has enabled non-coffee drinkers to also adapt coffee culture and become regular!

Technology

In a brick and mortar business, Luckin has focused on technology intervention to provide seamless experience to customers. When Luckin had launched, it was compulsory to order from Luckin’s app- with the first coffee being free or highly discounted. So, users would download the app to get their first coffee, and in future, all the purchases had to be made through the app- which led to higher retention as well as enabled Luckin to retarget the customers. It made the grab-and-go concept seamless, since the customers order the coffee from the closest outlet while sitting in an office and pick up the coffee once the app updates them of their coffee being ready.

Luckin also uses big data analytics to identify the sites for opening its stores, based on proprietary as well as 3P data. The system would take available information into account, like offline traffic data, competitors and customer profiles- suggesting malls or office complexes which could generate profitability.

Store Concept

Starbucks stores are located in shopping malls or affluent neighbourhoods, providing for an upscale experience, hence the coffee is also priced high. Also, people come to starbucks to hang out, meet with friends, colleagues or hold semi formal business meetings.

Luckin coffee has built ‘grab and go’ stores with limited seating- which enables it to price the coffee lower. Customers can order coffee on the Luckin App in advance and reach the store when it’s ready. This helps the company with lower capex as well as lower operational costs- leading to a faster breakeven.

Franchise model of Luckin! 🏢

Although all stores of Starbucks are company owned, Luckin has over 3000 stores which are franchise owned, out of the 9300. Luckin’s franchise business model is unique as it does not charge a fixed franchise fees from the partner and doesn’t charge royalty based on sales. Instead, it earns profits by sale of raw materials, which is completely controlled by Luckin, and sharing of gross profit if the store’s monthly gross profit is higher than $2800- which ensures its a profit making store! This aligns the franchise partner and Luckin’s incentive- since Luckin only makes money if the franchise partner makes money. With control of entire raw material and the equipment, Luckin is able to control the quality of the product across the stores.

Financial scam and the rebound! 🏀

Luckin Coffee went public on NASDAQ in May 2019, raising $645M! In 2020, a Muddy Water Research report alleged that Luckin had inflated sales of ~$300M. This led to the stock price dropping to $4.8 from $17 and eventually got delisted from NASDAQ in June 2020. Inspite of this, the model continued to work and Luckin made a strong come back in 2 years and is expected to overtake Starbucks in few years!

Local and global competition! 🏋️♂️

Apart from global competition from players like Starbucks, Lavazza, Mc Cafe, etc.- there are several venture backed local coffee companies which are trying to grab a piece of the pie!

In 2021, ~$800M was invested across 16 transactions in China’s coffee sector!

Today, Shanghai has over 8000 coffee shops- beating all other cities across the world! It clearly indicates the China has many micro markets which could accomodate more coffee stores as the middle class keeps rising and the China consumption story plays out and coffee becomes more functional than indulgence. In the next few years, coffee market in China is expected to reach ~$140B! Models like Luckin have also proven that by keeping opex and capex cost on the lower side, profitability can be achieved much faster- making the business viable!

FMCG opportunity 🏭

Not to forget, the largest opportunity lies in the FMCG industry but it has been dominated by legacy players like Nestle, or no? In 2015, Saturn Bird (三顿半) launched its instant coffee which is significantly better than any other instant coffee in the market- given the customer feedback.

Using freeze drying technology, liquid brew is put into small cups, as you can see above. The number denotes the intensity of the roast, 6 being the highest. A customer just needs to pour the cup in milk, hot water or cold water, stir lightly- and coffee dissolves, resembling taste of a freshly brewed coffee! Cost for a single cup comes around ~$1.

The company has raised over $50M and was valued at $625M in the last round of financing in 2021. Annual sales in 2022 are estimated to be $100M+ and it has surpassed Nestle in instant coffee sales on Taobao.

It launched ‘Project Return’, allowing customers to return the cups at offline stores (in partnership), incentivising users by receiving coffee powder in return.

Coffee across SEA! 🌏

Markets like Indonesia, Philippines and Singapore have mature coffee culture, with several companies scaling up with lower capex and lower opex model!

Kopi Kenangan, Indonesia

Founded in 2017, Kopi Kenangan is a billion dollar coffee chain from Indonesia- which has scaled up to 800+ outlets across the country. It has grown through company owned stores, focusing on grab and go- maintaining sustainability through smaller stores and pricing the coffee much lower than international chains like Starbucks

Jago Coffee, Indonesia

Jago Coffee, launched in 2020, is an innovative concept of serving coffee on the wheels, which is essentially organising an unorganised industry in Indonesia. The coffee is even cheaper than Kopi Kenangan since the company does not have to pay high capex or opex costs, since the cart does not need to pay rent and is operated by a single person. Throughput of one cart would be limited, hence Jago will have to launch thousands of cart to build a large business.

Flash Coffee, Singapore

If you are in Singapore, Flash Coffee stores will definitely grab your attention! Founded in 2019, Flash Coffee has over 250 stores across SEA and has raised over $65M since inception. Flash Coffee also operates in the grab and go space- keeping the costs lower and pricing competitive. Customer need to use their app to order coffee, at the store or for delivery- like Luckin coffee, enabling the customers to avoid waiting for their coffee in the store.

Pick Up Coffee

Pick Up Coffee is a Philippines based company, which started operations in 2022 and has opened over 60 outlets across the country. Being value focused, it offers premium coffee at much lower prices than other coffee chains. Again, this has been possible due to the smaller format of the stores- making the business more viable. It has raised over $35M since inception and is currently valued at $120M!

Insights for India! 🇮🇳

Like China, India is largely a tea drinking market! Over the last 2 decades, coffee culture has been improving, but it is still early days. ‘Filter-coffee’ is popular in the southern parts of the country and Instant coffee has been popular since it provides access to coffee at a lower price. Cafe Coffee Day is an Indian chain, which was the early mover in the coffee retail chain business in India, launched in late ‘90s. Over the last 20 years, the company scaled to thousands of stores and built a brand- but it ran into operational issues and has been struggling recently!

FMCG sector has also played an important role in increasing adoption of coffee in the country. Recently, liquid decoction is becoming popular- providing better instant coffee experience at competitive price of 5-10 cents!

India’s coffee retail chain market is ~$420M (2022) and growing rapidly! Moreover, India is a leading producer of Arabica and Robusta coffee, so there is no reliance on import of high quality coffee beans.

Starbucks has ~340 stores in India with $130M revenue (~$3.2B in China), being one of the largest coffee retail chains in India. There are Indian players like Blue Tokai and Third Wave , which have also opened over 50-100 stores each. The larger format stores have found it difficult to scale so far, unlike China, but they are picking up now.

Third Wave Coffee and Chaayos are Indian brands for coffee and tea respectively, and the price difference is evident- since tea is more functional whereas coffee is premium indulgence! In fact, most of the large outlets in India take over ~2-3 years to recover their capex.

It’s clear that China has ~5 times higher GDP per capita, hence Chinese consumers have a significantly higher disposable income than Indian consumers. Hence, the $3-5 price point for coffee has been one of the bottlenecks for larger Indian consumers to indulge in coffee.

That being said, the Indian middle class is rising fast and we can expect a boom in India’s coffee consumption over the next 15-20 years, looking at the trends in China!

Going forward, it is fair to expect a large coffee chain on the grab-and-go model, serving high-quality, localised coffee at lower prices, making coffee more functional for the Indian consumer!

If you are making coffee accessible for the masses in India, let’s chat? rahul@oldrope.club