EdTech’s outlook in winter!❄️🧑🏫

EdTech was one of the beneficiaries of covid 2020 pandemic with VCs flocking to invest in companies & students adapting to new ways of learning. Here's a note on changing macro env. and tips for prep!

Welcome to Old Rope. I write on emerging trends from the East! 🌏 Subscribe to stay updated.

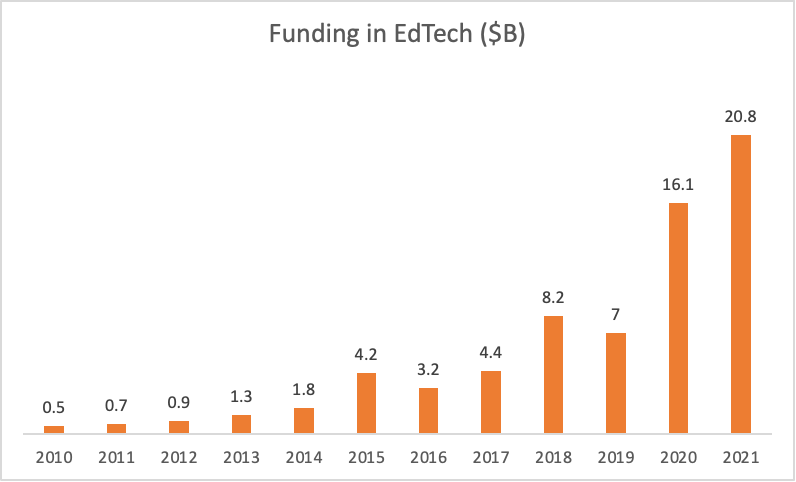

With influx of $16B in 2020 and $21B in 2021, it has been an exciting few years for EdTech investors, founders and stakeholders, with leading players likely gunning for IPO. However, the slowdown in capital markets is bound to affect most of the EdTech companies too, with varied degree of impact.

Although pandemic brought tough times all across the globe, but it also created opportunities- especially in EdTech. We witnessed disruptions across content delivery, hybrid learning, personalised tutoring, EdTech infra, etc- with lots of capital at disposal.

Public Markets have been brutal recently! 📉

With so much dry powder with PE VC firms, why are we expecting a slow down? Well, the public markets have been giving lowering exit expectations, and things are trickling down to the basics.

Several EdTech companies went public in 2021, and correction in valuation is stark.

At the same time it is very interesting to note that the companies are performing at their peak!

So…it seems investors are expecting that opening up of the world- schools, colleges, etc. might have adverse impact on EdTech companies…which may (or not) be true?!

It’s also important to note that some of these companies were over-valued last year…and now the valuations are correcting.

Private Markets follow Public Markets 🚶

Until last month or so, EdTech companies were raising capital at 20-100X of their ‘Annualized Revenue Run-rate’ (where ARR is often calculated creatively). Most recently I came across a live learning platform which raised capital at $100M valuation, with ~$3M booking revenue run-rate.

The above multiples are not sustainable, as the private market valuations are inching towards the public markets, in the range of 5-10X, depending on the business model. Hence, it will be important for founders to adjust their expectations.

In spite of the funding raised, many companies have not been able to build capital efficient businesses, which has led to massive lay offs across some well capitalised EdTech companies.

In their heyday, EdTech companies were building multiple businesses and hiring incessantly. This led to growth at the cost of sustainability, loads of confusion and inefficiency. The recent slow down has given a reality check, coupled with an opportunity to readjust towards sustainability.

Macros…are fine?

There is a general perception that EdTech is going through a reset since the world is opening up. Will the students and parents still opt for online tutoring?

Since we are going through recession and increase in interest rates, consumer spending is expected to come down. Will this reduce the spending on education?

Overall, the innovation and investments have enabled the stakeholders [in education] realise the net positive of EdTech and I expect it to continue for the long term.

Students and parents across the world were locked down for almost 2 years, allowing EdTech companies to innovate on delivery of education. Since education was being delivered in a digital first fashion, it allowed for data collection leading to personalisation (to some extent). In the post covid era, we are seeing students learn online and offline, picking best of both worlds!

Working professionals’ up-skilling became even more interesting as learning online became the new normal and people could take time out of their ‘work from home’ routines. With awareness in the environment, we can see interest from more working professionals towards up-skilling as it translates into better salary, career switch, etc.

Schools, universities and offline institutes saw their status-quo being challenged, but then EdTech infra came to rescue. Not only the institutions were able to operate in the covid world, but also explore hybrid learning- a key stepping stone in the sector, going forward.

That being said, access still remains limited with bottlenecks around internet connectivity, mobile device penetration and affordability in emerging economies.

Not only in EdTech, but we are seeing a slowdown in venture capital across.

How to plan for the months ahead? 📒

Given that raising money is going to be hard in the next few quarters, it is very important to chart out strategy to stay afloat and make it to the other side of the river.

Most EdTech companies (consumer facing) are suffering a CAC problem, where the contribution margin are squeezed out, often -ve! Companies should start focusing on increasing their gross margin by optimising on cost of teaching and delivery, and solve distribution which can further improve contribution margin.

Scale is important….but not at the cost of negative contribution margin.

Distribution first plays (like Quizziz, Brainly, etc.) have inherent advantage of high gross margins, but they need to optimize for monetization, sooner than later. Since some of the players will have no monetisation built in, the best way forward could be to partner with other EdTech companies which have not been able to solve for top of the funnel. For example, live tutoring platforms are looking for cheaper lead acquisition sources, and traffic heavy platforms are looking for ways of monetizing the traffic.

If you are looking to explore such synergies, feel free to reach me: rahul@oldrope.club. Will try to match-make!

Consumer spending is likely to reduce, as we have entered phase of high inflation.

Education spending in ‘must to study’ segments is less likely to be affected but there could be some impact in ‘good to study’ segments. For example: Parents would still spend money for after school tutoring to prepare for exams, but might not take that extra curricular French class, if there is limited budget available.

If your company is operating in ‘good to have’ segment, it will be important to assess demand, by looking at the trend of CAC, talking to end users, etc. and plan diversification, if possible.

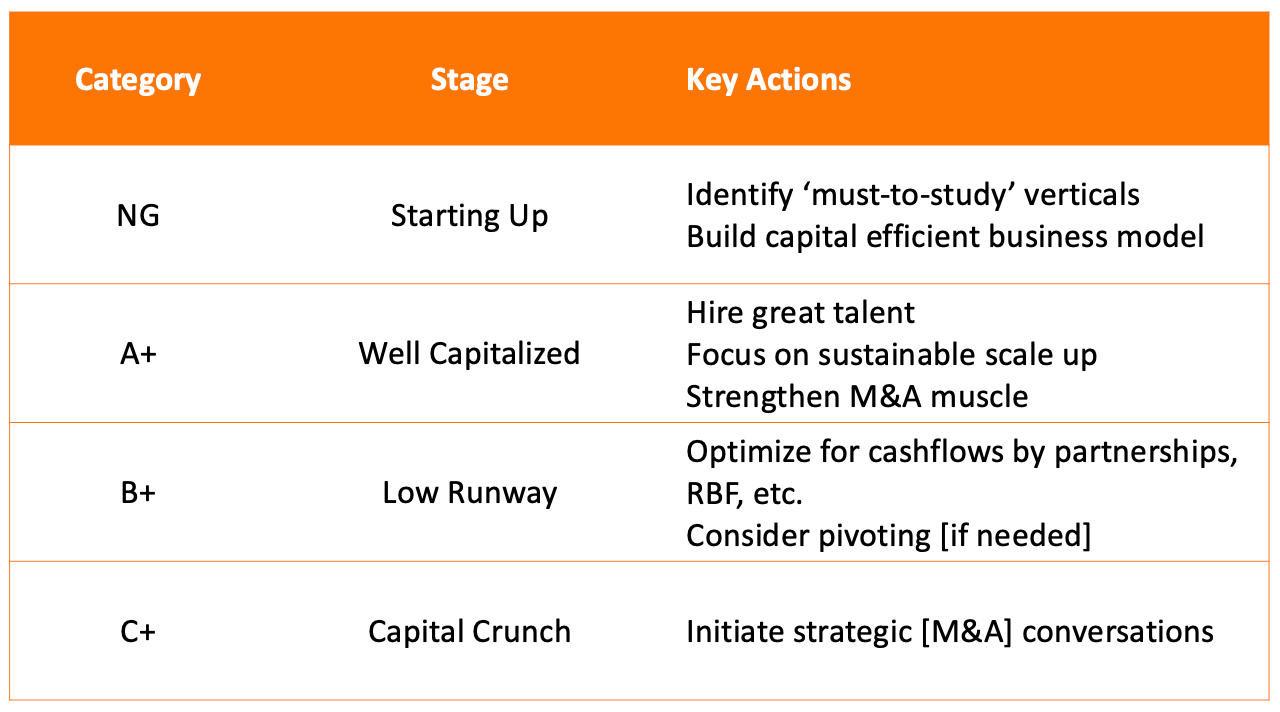

Given companies are at different points in their journey, let’s help plan contextually 🪧

NG: Starting Up

For founders looking to startup in EdTech, it’s important to be cognisant of the macro environment- slow fundraising, schools opening up, reduction in consumer spending etc. Therefore, it is important to solve unique problems, for example- the billion dollar CAC problem; and operate in ‘must-to-study’ verticals which have high demand. Moreover, there are various opportunities in the Ed-Infra space which is a lot more capital efficient, and is expected to gain momentum in hybrid environment.

A+: Well Capitalised

For companies which have figured out a cashflow positive model OR raised capital for 3 years or more runway, it’s a special time to be building. Given the slowdown, a lot of companies are in stress and are looking for a buyer- this could be one of the best times to acquire great assets at reasonable valuations. It is also a good time to hire great talent, given the layoffs and hiring freeze across. Lastly, it is important to scale in sustainable fashion as the cost of acquisition is expected to reduce, given that incumbents will reduce spends.

B+: Low Runway

For companies with high burn and low runway, it is obvious to optimize for net cashflows and making it alive through the tough times. Assuming raising primary capital is not an option, considering revenue based finance can be of use and force one to build business in capital efficient manner. In some cases, it would also mean pivoting verticals from ‘good-to-study’ to ‘must-to-study’.

C+: Capital Crunch

For companies with last few months of money in the bank, and no foresight of funding, it will be important to explore plan B i.e. M&A. There are many companies which have been able to raise funding in the last two years and have long runway- actively looking for inorganic growth opportunities. For the least, it will be good to build relationships with different players across and explore synergies as the runway hits the 3 months mark. If you are exploring M&A opportunities, feel free to drop me a line: rahul@oldrope.club; I will try to do my best.

Summing up! ✍️

Broadly, these are exciting times for EdTech sector, as companies and founders are being tested on various levels- agility, capital efficiency and perseverance. Companies which will be able to cross the chasm will build for the steady state of Education- which will neither be completely online or offline. Changing macro environment will handsomely reward the players which will make it to the other side- enabling them to build for the next billion learners.

Wishing everyone lots of luck as they build during tough times, feel free to reach me, if you think I can help: rahul@oldope.club

Yikes! Looks like cohort based learning (or something like Coursera) seems to sustain in all kinds of markets?

https://lightbox.vc/new-thinking/cohort-based-courses