Community Group Buying in China- Tale of New Retail ($4.6B funded- Xing Sheng You Xuan 兴盛优选)🛒🇨🇳💰

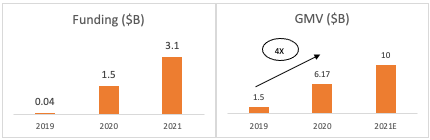

Community Group Buying became really popular in China, especially during & post the pandemic. Chinese companies have raised billions of dollars, with Xing Sheng You Xuan 兴盛优选 leading the bandwagon.

I am starting a closed community for folks who want to learn about all things China-tech. The purpose is to share frequent knowledge, updates about local tech, and to learn from experts.

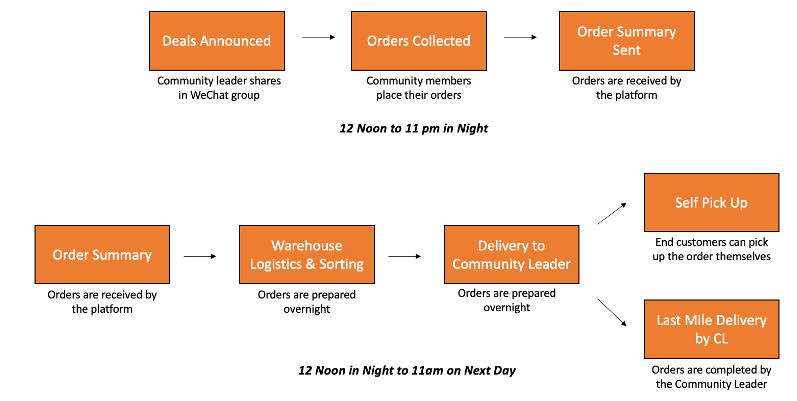

Community group buying- CGB (社区团购) is a hyper-local retail model, which relies on personal network of individuals (community leaders) for organizing group purchase at discounted prices of grocery items, etc. Community leaders convene customers living in proximity through their social network and organize the purchase through WeChat, by sending out offers on group chat, collecting and fulfilling the orders for a ~10% commission.

Although there is huge investor interest in the sector, there are some fundamental concerns that surround this sector as well. Is this sustainable for companies? What does the policy landscape look like? Let’s deep dive through a case study on Xing Sheng You Xuan.

Xing Sheng You Xuan 兴盛优选 🛒

Founded in 2018, Xing Sheng You Xuan- XSYX (兴盛优选) is a Chinese CGB platform, catering to daily household grocery items such as fruits, vegetables, meat (fresh), rice, oil, etc. It branched from a decade old supermarket chain, Furong Xingsheng (芙蓉兴盛), with over $6.17B GMV in 2020.

Founded in 2019, Furong Xingsheng (芙蓉兴盛) is a supermarket chain started in Hunan. It currently has over 17K+ community supermarkets in 16+ provinces, operating on a franchise model.

Grocery Market Size in China 🍌🍖

Given its population, China naturally has one of the largest grocery markets across the world. Its fresh grocery market is currently around $729B with only 8% penetrated by ecommerce players; and the daily necessity market is around $857B with 27.5% online penetration. Here fresh grocery accounts for fresh vegetables, fruits, meats, eggs, etc. and daily necessities account for household supplies like dairy products, packaged foods, personal care products, etc.

Fresh grocery market is expected to grow at a CAGR of 6% for the next 5 years; and the daily necessities market is expected to grow at a CAGR of 6.9% .

It’s important to note that the market is still predominantly offline, and most shoppers are from tier 1 and tier 2 cities accessing online grocery shopping. Hence, it creates great scope for community buying for groceries. Almost 1 billion people in China live in rural and smaller cities.

Community Group Buying(社区团购)🧑🏽🤝🧑🏻🛒

For the upstream ecommerce players, penetrating in rural China has been difficult due to inefficient user acquisition and last mile logistics. With community buying, the hypothesis is to build a cheaper channel of user acquisition (through networks of community leaders) and more efficient last mile logistics by relying on self-pick-up points/ community leaders.

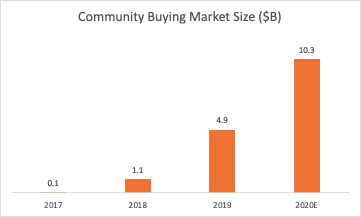

Community buying was expected to have GMV of $10.3B in 2020 which means there’s a lot of potential in the above channel.

Curious case of Changsha 🕵️♂️

Changsha, capital of Hunan province, is a tier 2 city in China, where the CGB model became very popular before exploding towards the rest of the country. There were more than 30-40 community buying companies in the city at one time, with 4-5 in the same community at the same time.

Amongst other reasons, Changsha has a superior supply chain advantage when it comes to fresh food. Local government authorities have focused on improving the infrastructure for supply chain in fresh agricultural produce. Since 2017, over 16 fresh supermarket brands have entered Changsha, including Alibaba’s Hema Fresh, Tencent’s Yonghui, etc. This has enabled the community group buying companies to take advantage of the supply chain and build their platforms in the city, and then expand in other parts of China.

Xing Sheng You Xuan, starting from Changsha has been leading the bandwagon 🚀

Supply Chain is the real MOAT ⛓️

Supply chain determines the stocking capacity of goods and the timeliness of arrival of the goods.

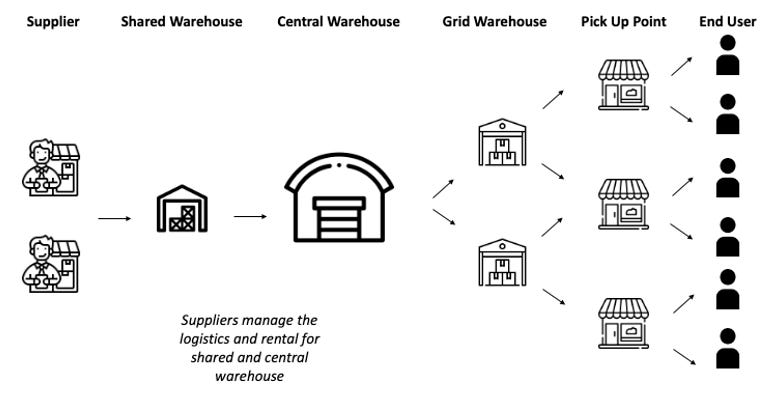

Since its establishment, XSYX has iterated on various logistics models and has formed a complete supply chain system. Through its self-built ordering platform- one end is connected to upstream suppliers and the other is connected to downstream convenience store outlets.

The orders are collected by 11pm in the night and delivered to the community leader pick up point by 11 am in the morning.

Most suppliers themselves will build warehouses and rent warehouses near the central warehouse to facilitate supply to the central warehouse, and some commodities such as vegetables will be first supplied to the shared warehouse for processing and packaging, and then the platform party will build its own capacity to pull it to the central warehouse.

Every day or after the order of each batch of group products is received, the central warehouse will start to sort the products according to the user's area and deliver them to the grid warehouse in the city by freight.

The grid warehouse is generally responsible for the orders of all stores in a county on the map. The goods will be sorted and packaged at the order level here, and finally distributed to the respective stores or community leaders stores.

After receiving the goods, the community leader temporarily stores them (some of them need to be refrigerated), and then informs the user to pick up the goods, write off the delivery code, and finally get a commission receivable after the order is delivered.

The advantage of this model is zero inventory and zero risk.

The goods are mainly backlogged in the supplier's warehouse, and XSYX has no risk in this regard. If the platform is going to sell 10,000 packs of apples that day, and finally sells 7,000 packs, the remaining 3,000 packs will be absorbed by the supplier.

Persona of Community Leaders 团长 🧑🌾

These community leaders are the micro influencers who are building hyperlocal WeChat communities to post the deals from the platform along with acting as delivery points.

Mom and Pop Store Owners

Community leaders for XSYX are mostly small store owners who can use their shop as a delivery location for the goods being delivered by the platform, and their existing network can also become end customer- build WeChat groups of 100+ potential customers. These leaders are acquired by offline feet on street teams and referrals.

They make 10-12% commission on the GMV of sales and the community leaders are able to make an income of $300-$500 per month.

Fresh-food is the entry point for CGB 🥬🥩

Since fresh food is unbranded and is difficult to differentiate (assuming standard taste and quality), hence the users are not particular about the platform. Consumption frequency of fruits, vegetables, and meat is very high, and one doesn’t like to store it for a long time. Along with fresh, basic grocery items like oil, milk, spices, etc. are also common products on these platforms since brands are pretty commoditized. As brands become more important, then it changes the decision making at the customer’s end in terms of choosing the platform (community leader).

CGB has been tried before but what’s the trigger recently?

During Covid-19, China went through a strict nationwide lockdown last year which made it difficult for users to shop offline. In the smaller towns and villages, the penetration of e-commerce giants is low, hence community group buying got wide scale adoption. This also let the end users realise the convenience, cost efficiency and helped community leaders make some part time income.

The WeChat ecosystem has also made the community buying process really easy for the end users, where they can receive exciting deals of the products they need on a daily basis and can place orders with community leaders on the app itself.

People in lower tiered cities are more price sensitive hence group purchase with heavy discounts is encouraging for them to adopt the model.

The community leaders are also keen to make some passive income by putting in a few hours of extra work. There are additional incentives- as they get more footfall in their stores, which also enables more business for their store apart from the commission income they earn through platforms.

Unit Economics shows that it’s a tough business! 🪙

Competitive Landscape- Red Ocean! 🦈🩸

XSYX has been one of the fastest growing platforms and has been able to leverage its decade old expertise in supermarket franchise business.

China tech giants are also actively participating in the space! 📈

Alibaba, JD, Pingduoduo have to participate in this market since that’s the natural way for them to penetrate the rural market. Some of them have launched their own products (like Pingduoduo has DuoDuo MaiCai 多多买菜,Kuai Tuantuan 快团团).Also, there is active participation by the tech giants as investors.

Due to the anti monopoly laws, not every player can directly participate in the business, hence they have also been investing.

Lately, there have been multiple concerns surrounding the industry 😰

Policy environment has not been in complete favour of community group buying because the business model displaces the local vegetable vendors from their daily livelihoods. Important to note that well-funded tech companies have to be summoned to the policy environment in China, in spite of their stage or scale.

Because of the influx of capital, it has become difficult to acquire and retain the community leaders which is one of the most important levers in sustainability of the business. Specific to retention, the community leaders have several options and might choose to switch to a platform which is offering better commissions (read PE-VC funding).

It’s against the law to have any kind of exclusivity with the community leaders since they can’t be bound by a platform when there is a better offer from another platform. Nicetuan, one the leading community buying platforms was recently fined for anti-monopoly practice.

As seen above, the unit economics are still not attractive, given the companies are at substantial traction to reach economies of scale.

Potential Valuation 🏛️📈

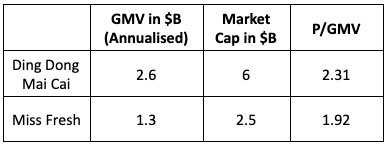

Looking at two recent IPOs of Ding Dong Mai Cai 叮咚买菜,Miss Fresh每日优鲜, I have tried to compute potential valuation for XSYX.

Given it plans to achieve $10B GMV by end of 2021, it could be valued at 2X of GMV, i.e. ~$20B

India and SEA is also seeing considerable action, following the China CGB hypothesis 🌏

Conclusion ✍️

Grocery and fresh is a very deep category with unrealised potential of online commerce in rural China. New retail formats like community group buying have a very large opportunity lying in front of them. I wonder what will happen as the logistics ecosystem improves in rural China? Maybe it’s a long road to that!

Real MOATs in the business can be built around an efficient supply chain since other pieces of the value chain are commoditized or replaceable.

Billions of dollars has flown into this segment by tech giants and PE firms, which has led to fundamental challenges. Though the idea was to save cost on user acquisition but the costs on acquiring and retaining community leaders has been going up due to intense competition.

The business model is yet to be proven, but it could make sense as there is more consolidation after the companies burn through the investor’s cash.

Lastly, the biggest risk in my opinion is the regulatory challenges. Chinese policy system has been unpredictable by the tech-giants. I won’t be surprised if there are strict regulations to follow for community buying platforms.

Here’s a podcast of Shihuituan’s founder by GGV Capital. Shihuituan/ Nicetuan is one of the largest companies in CGB.

I am starting a closed community for folks who want to learn about all things China-tech. The purpose is to share frequent knowledge, updates about local tech, and to learn from experts.

Update (July 9, 2021): Tongcheng Life (同程生活), founded in 2018, has filed for bankruptcy after raising $300M+, owing several $millions to its suppliers. It was one of the largest players in the community group buying sector.

Solid stuff Rahul

This is a very good case study.

I am just curious to ask what should be the reason that 27.5% of daily essential is delivered by online players in China while in india, this segment is struggling including Milk basket?