BYJU’s buying Aakash for $1B? Is it really huge?

A lot of news recently about the big buy-out by BYJU's for Aakash Educational Services got me thinking what could have been possible if AES had a different vision. Here's an analogy from China 🇨🇳

BYJU’s, one of the biggest ed-tech start-ups in the world is on a journey to win the Indian (soon global) education market. I wrote about the horizontal path BYJU’s is taking and some analogies with Yuanfudao: here. So if BYJU’s acquires Aakash, it’s nothing surprising and we could see more M&As in upskilling, education SAAS, co-currcilar, etc.

According to YourStory, BYJU’s is acquiring Aakash Educational Services (backed by Blackstone) for $1B, where Aakash family may exit with $300M cash and Blackstone Group may own ~5% of BYJU’s. It seems pretty good, at the first look, but the more I think about it, I feel Aakash could have been on the other side.

Started in 1988, Aakash Educational Services runs one of the largest offline coaching institute network for test prep with over 200 institutes pan India. It is popular for school students preparing for entrance exams like NEET (Medical), IIT JEE (Engineering), also catering to students preparing for competitive exams, Olympiads etc.

Whenever I think of Aakash/ FIITJEE/ Allen, it leads me to think of TAL (学而思) or New Oriental (新东方) from China which started in the same era, with similar value proposition and are listed in US and are worth ~$40B and ~$30B respectively.

TAL (学而思): Tomorrow Advancing Life

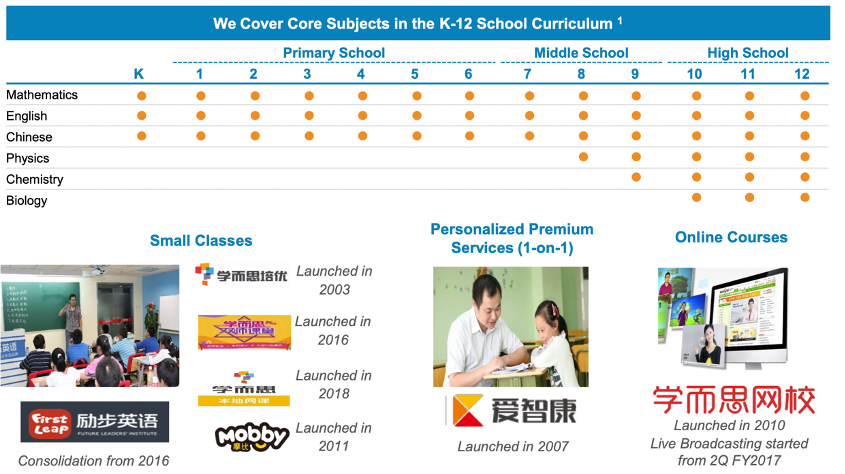

TAL provides K12 education services in China operating over 600 learning centers in 50+ cities, focusing on students from preschool to grade 12, offering small classes, personalised premium services, and online courses. It is popular for math and science tutoring.

It started as an offline coaching center for Math tutoring 18 years back and has now evolved into a comprehensive offline-online tutoring platform using technology as an enabler.

TAL has been investing in R&D for building AI enabled classrooms which can create personalised experience for the students and improve their performance. More can be read here.

It has invested in 50+ education companies in China and overseas. Some portfolio companies include likes of Kaishu Jian Gushi (凯叔讲故事), Vedantu, Dada ABC (达达ABC), Squirrel AI (松鼠AI), etc.

New Oriental Education (新东方)

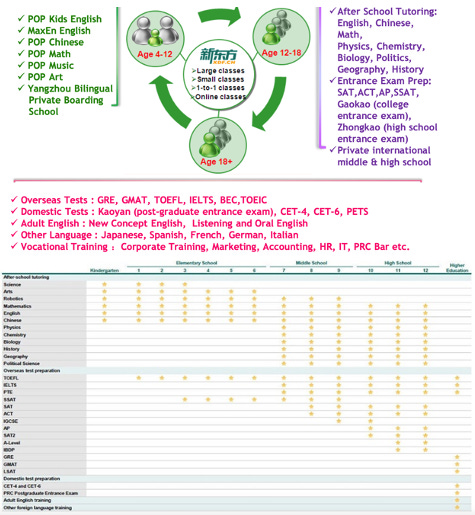

New Oriental Education provides K12 education services in China operating over 1400 offline centres across 50+ cities on students from preschool to grade 12, offering small classes, personalised premium services, and online courses. It is widely known for English tutoring.

It started in Beijing, China (1993) with TOEFL test preparation courses to college students. The company has expanded vertically and horizontally today and its service portfolio looks very diverse.

The story of rise of New Oriental is really interesting- movie worthy 🍿, and there’s actually movie one could watch too- American Dreams in China.

New Oriental has invested in over 30 companies like VIPThink, Kaishu Jiang Gushi (凯叔讲故事), Wonder Painter, etc.

After looking at the above companies, I feel Aakash was sitting on a much larger opportunity.

Some thoughts:

Evolution is necessary to stay relevant

It can be seen by the above examples that the companies evolved with time and made necessary pivots to stay relevant and guide the direction of education-technology industry. Just positioning as a tech-company is not enough, it’s important to think two steps further and execute in the right direction.

Today, Aakash could have been buying BYJU’s, who knows?!

Horizontal Expansion

It’s important to focus and build a brand in a domain, but it’s essentially a good go-to-market strategy, not the end game. After achieving success in a certain domain(s), a firm should use its position to expand to other verticals to ensure higher LTV as well as market potential.

Leadership

The best leaders always surround themselves with individuals who are better than they are. Instead of changing oneself, hiring smart people ‘who can focus on present, think about the future and execute fast’ is the key to build longevity.

Building everything might not be the fastest way, hence acquiring or investing in great companies early on is one of the ways to bridge the gap.

Serendipity: BYJU’s ticks all of the above 😉

One could argue that India and China are different markets and it’s not fair to compare with the above companies. Aakash Education Services ($1B) is 2.5% of TAL ($40B) in market value, but recent ed-tech companies have proved that Indian education opportunity is big enough. At least in after-school K12 education, India can potentially (I hope) stand toe to toe with China!